- ESG / Sustainability

Build Investor Trust with OGMP-aligned ESG Reporting

Deliver transparent methane metrics aligned to OGMP and other frameworks without endless back-and-forth with operations or auditors.

- ESG / Sustainability

Build ESG disclosures that earn investor confidence

Deliver transparent methane metrics aligned to OGMP and other frameworks without endless back-and-forth with operations or auditors.

- What you’re up against

Sustainability reporting isn’t just technical — it’s reputational and it’s hard.

How Highwood helps

ESG / Sustainability leaders

Platform

Better alignment with OGMP, CDP, and other ESG scoring frameworks that require credible, audit-ready methane data.

Consulting

Expert guidance to translate emissions inventories into investor-grade ESG narratives — including KPI design, materiality mapping, and rater readiness.

Education

Training for ESG teams on methane metrics, protocol alignment, and how to communicate performance credibly across audiences.

What you gain

Credible disclosures

Defensible methane and GHG data mapped to regulatory and investor frameworks.

Stronger ESG ratings

Better alignment with OGMP, CDP, Sustainalytics, and ISSB scoring logic.

Fewer surprises

Avoid last-minute scrambles when inventory numbers change — and explain shifts with clarity.

Cross-team coordination

Work seamlessly with ops, legal, finance, and investor relations — with data everyone can trust.

Reputation resilience

Demonstrate leadership on climate accountability — before questions are asked.

- Executive Snapshot

“Highwood EIP helps you deliver investor-grade methane reporting, without wrestling with messy field data.”

VP, Sustainability Reporting

- US Public Producer

- Frequently asked questions

Aligning methane disclosures with ESG strategy and investor expectations

How do I ensure methane reporting aligns with investor-grade ESG disclosure standards?

Start by mapping emissions data to frameworks like TCFD, OGMP 2.0, and ISSB. Use measurement-informed data wherever possible, and clearly communicate assumptions, uncertainty, and verification steps.

What’s the role of OGMP 2.0 in ESG storytelling and market credibility?

Achieving Level 4 or 5 under OGMP 2.0 signals serious commitment to transparent, science-based methane disclosure — a strong signal to investors, regulators, and ESG raters alike.

How can I position our methane performance to ratings agencies and sustainability indexes?

Highlight not just absolute emissions, but methodology improvements, audit-readiness, and measurement coverage. Contextualize performance within your peers and show year-over-year improvement.

What do ESG investors want to see in methane disclosures that compliance reports don’t usually cover?

Investors want clarity on materiality, governance structures, target ambition, and real-world performance — not just rule adherence. Visuals, benchmarks, and plain-language framing help.

How do I explain changes to methane inventory numbers across reporting cycles?

Use side-by-side disclosures showing methodological evolution, measurement upgrades, or reconciliation improvements. Transparency earns trust, even when numbers rise.

What frameworks should methane reporting align with to satisfy ESG and regulatory audiences?

Align with OGMP 2.0, EUMR, TCFD, and ISSB. SEC’s climate disclosure rules will also require Scope 1 data transparency, so consistency across disclosures is critical.

How do I handle third-party measurement data in our ESG reporting?

Disclose vendor methods, data quality, verification steps, and how third-party results were incorporated into inventories. Ensure consistency in narrative and numeric reporting.

What metrics or KPIs resonate most with ESG analysts when evaluating methane performance?

KPIs like methane intensity, percentage of emissions measured vs. estimated, leak response time, and OGMP compliance level all support credible storytelling.

How can I simplify methane data for boardroom and investor presentations?

Focus on trendlines, material risks, and compliance progress. Use plain language summaries with appendices for technical detail.

What’s the reputational risk of poor methane reporting — and how do I mitigate it?

Inconsistent data, unexplained variances, or late disclosures can erode trust. Mitigate by standardizing across business units, building defensible narratives, and engaging early with ESG raters.

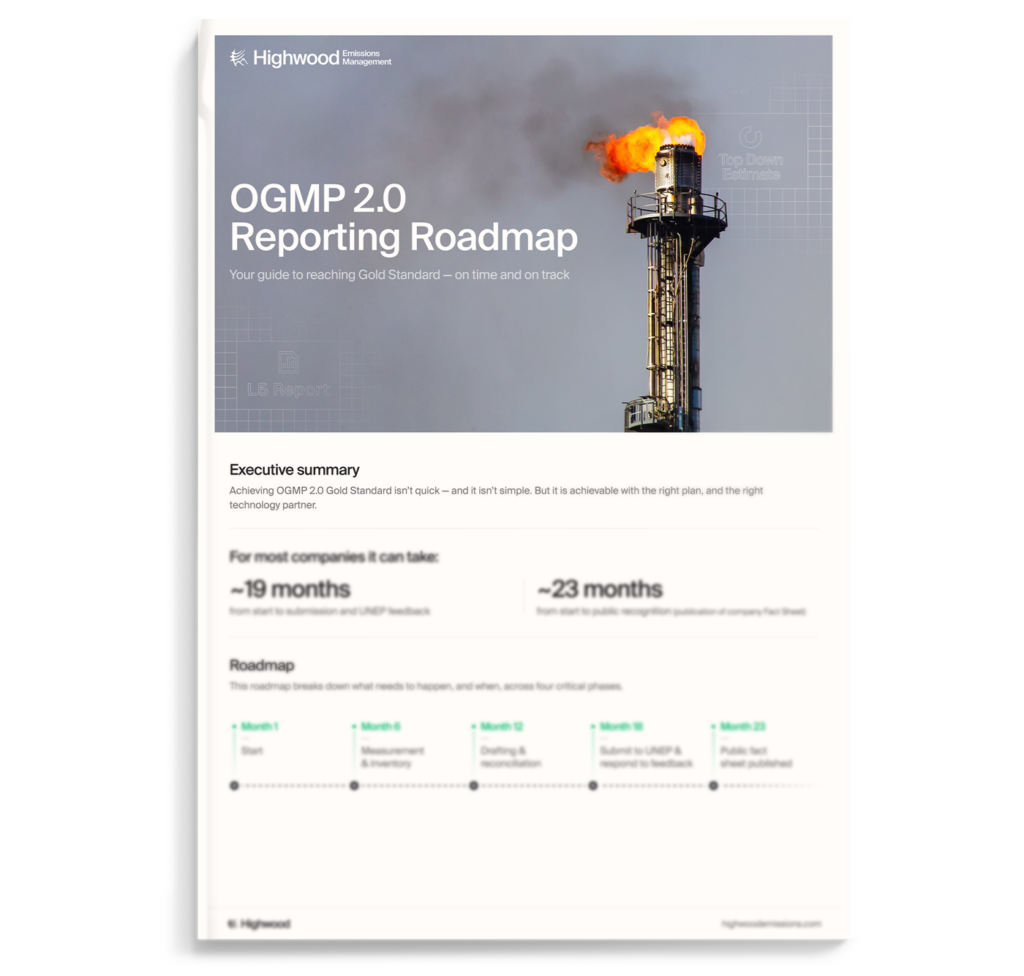

- Free Report

OGMP 2.0 Gold Certification: How long will it take?

Download the OGMP 2.0 Reporting Roadmap — a printable guide adapted from industry timelines — to see what’s involved.

- Get started