- C-Suite / Finance & Risk

Turn methane compliance into capital advantage

Protect market access, boost investor confidence, and model clear ROI from methane investments — while reducing regulatory exposure and strengthening ESG credentials.

- C-Suite / Finance & Risk

Turn methane compliance into capital advantage

Protect market access, boost investor confidence, and model clear ROI from methane investments — while reducing regulatory exposure and strengthening ESG credentials.

- What you’re up against

Compliance costs are rising — but the cost of losing access is greater

How Highwood helps

C-Suite / Finance & Risk leaders

Platform

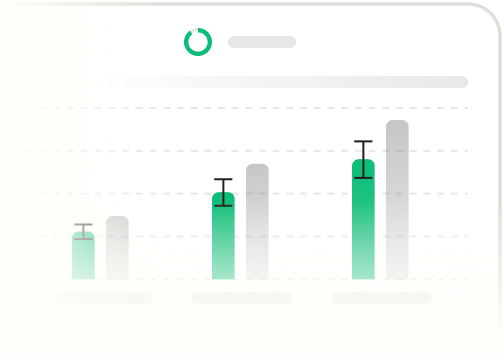

Consolidates enterprise methane data, automates audit-ready reports, and delivers actionable business and market intelligence—all in one executive view.

Consulting

Financial modeling of emissions investments, payback timelines, and portfolio-wide compliance strategies — tailored to your budget cycles.

Education

Briefings and toolkits for finance teams, executives, and boards to align methane strategy with enterprise value and investor expectations.

What you gain

Financial clarity & ROI

Know where methane spend goes—and what it yields in cost savings, uptime, and asset value.

Access to capital

Help secure funding by meeting ESG investor demands and proving methane discipline.

Market access protection

Safeguard EU and premium markets by avoiding penalties under OGMP-linked trade rules.

Lower compliance risk

Minimize legal exposure, fine risk, and reporting delays with structured, audit-ready systems.

Strategic agility

Scale solutions up or down as regulations, investor demands, or asset priorities shift.

- Executive Snapshot

“Highwood EIP gives you cost control, reputational protection, and investor-ready transparency — in one platform”

CFO, Public North American Producer

- Verified

- Frequently asked questions

Making the business case for methane and GHG investments

How does methane performance affect access to international markets like the EU?

Regulations like the EU Methane Regulation require verified emissions data for cross-border operations. Non-compliance risks penalties, reputational damage, and restricted market access for exported fuels.

How do ESG investors evaluate methane management — and why does it impact cost of capital?

Many institutional investors now screen for OGMP 2.0 participation, methane intensity, and third-party verification. Strong methane controls can unlock ESG-linked financing and lower capital costs.

What’s the ROI of investing in more accurate methane measurement technologies?

Benefits include avoided fines, fewer re-surveys, enhanced asset valuation, stronger ESG scores, and increased investor confidence — all contributing to risk-adjusted financial returns.

How can I model long-term cost savings from automating methane data collection and reporting?

Include direct savings from labor, audits, and penalties — plus indirect gains from insurer incentives, reduced production loss, and time-to-report compression.

How should I prioritize methane investments across assets from a financial standpoint?

Use a capital allocation model that factors in asset value, regulatory risk, emissions intensity, and investor visibility — prioritizing high-ROI, high-exposure basins.

What are the hidden costs of methane non-compliance?

These include litigation risk, reputational drag on equity valuation, delayed project approvals, and potential exclusion from ESG-aligned investment products.

How do I evaluate technology or data vendors in terms of financial value — not just features?

Score based on total cost of ownership (TCO), audit defensibility, support model, and ability to deliver data that aligns with ESG disclosures and investor expectations.

What metrics should I use to demonstrate methane ROI to boards or audit committees?

Key metrics include methane intensity reduction, audit cycle time saved, cost per tonne mitigated, and ESG rating deltas post-implementation.

How do I shift methane investments from “compliance spend” to “strategic value driver” in the eyes of the board?

Reframe the narrative around risk reduction, capital access, market eligibility, and long-term valuation resilience — all supported by defensible data and financial clarity.

What’s the typical payback period for continuous monitoring compared to periodic inspections?

Depending on leak frequency and asset type, continuous monitoring systems typically reach payback within 12–36 months via production savings and regulatory risk mitigation.

- Free Report