The EU’s groundbreaking methane regulations represent a major shift in the global energy landscape, creating challenges and opportunities for exporters, particularly LNG exporters targeting the European market. By mandating stringent monitoring, measurement, reporting, and verification (MMRV) standards, the regulations aim to reduce methane emissions and enhance transparency across the oil and gas supply chain.

The new EU methane regulations were introduced in a previous Highwood article. In this article, I discuss the risks and opportunities confronting LNG Exporters relating to the EU methane regulation.

The Risk for LNG Exporters

The EU is one of the world’s largest importers of oil and gas, and new methane rules, although still undefined in practice, will have sweeping impacts on LNG exporters. Key risks include:

- Compliance Uncertainty: The precise details of compliance mechanisms are not yet defined, creating ambiguity for LNG exporters. This requires exporters to interpret requirements creatively and prepare accordingly.

- Supply Chain Transparency: Exporters must trace gas back to their producers to ensure compliance. This is particularly challenging when gas is purchased from hubs with limited producer-specific data.

- Competitive Cost Disadvantage: Failure to meet the EU’s progressive methane intensity and MMRV standards risks dissuasive financial penalties by regulators, which will enforce maximum methane intensity thresholds by 2030.

The European Commission is developing a publicly available Methane Transparency Database, which is anticipated to be available beginning in 2026. This will include producer methane performance, leveraging both reported data and satellite measurements. This will amplify pressure to meet sustainability-conscious European consumer demands.

Strategic Responses to EU Regulations

To meet the EU’s methane regulations, exporters should focus on strategic investments in compliance, building partnerships with aligned suppliers, and fostering collaboration with certification entities. Proactively monitoring market trends, adopting traceability systems, and leveraging recognized certifications can enhance transparency and differentiation. These steps will ensure exporters remain competitive while adapting to the shifting regulatory and market landscape. Strategic responses can include:

- Investing in Compliance: Anticipate additional costs associated with aligning with EU standards, including securing partnerships with compliant suppliers.

- Collaborating on Creative Solutions: Explore opportunities for collaborations with producers and certification entities. This could involve proof-of-concept projects to understand the mechanics of compliance and the needs of operators and producers.

- Engaging with Suppliers: When purchasing gas from upstream supply chain participants, identifying compliant producers is critical. For non-compliant suppliers, there is an opportunity for exporters to engage in discussions and develop cost-effective strategies to ensure future compliance.

- Understanding Market Trends: Monitor how much gas is being imported into Europe and identify other markets that may follow suit. Staying informed on market trends and trader sentiments is vital for strategic positioning.

- Evaluating Implementation of Different Mechanisms to Trace Emissions Intensity: Investigate how to develop robust mechanisms for tracing emissions of producers that are selling product which end in LNG export. This requires a thorough understanding of the certification landscape and the ability to establish reliable tracking systems.

- Evaluating Purchasing from Hubs: In cases where you are the exporter and are purchasing gas from hubs, there is a lack of knowledge regarding the producers’ compliance with EU regulations.

- Engagement with Certifications: Collaborating with certification entities like OGMP2.0 or MiQ to trace gas origin and verify compliance offers differentiation in a highly competitive market.

In this complex environment, LNG exporters must remain agile and proactive. By understanding the regulatory landscape, engaging with producers, and investing in compliance, companies can navigate the unknown future of LNG exports successfully.

How Highwood can help

Highwood recommends working with producers, hubs, traders, and certification bodies to develop proof-of-concept projects to ensure clarity on the cost and efficacy of compliance mechanisms.

An approach that evaluates how to help LNG exporters de-risk the evolving EU methane requirements can also capitalize on opportunities ahead of competitors. By conducting in-depth market analyses, Highwood works with clients to uncover trends, evaluate vulnerabilities, and pinpoint strategic opportunities for compliance and differentiation. This includes assessing the feasibility of trace and claim mechanisms, analyzing voluntary standards like OGMP 2.0 and MiQ, and exploring innovative solutions for transparency and accountability.

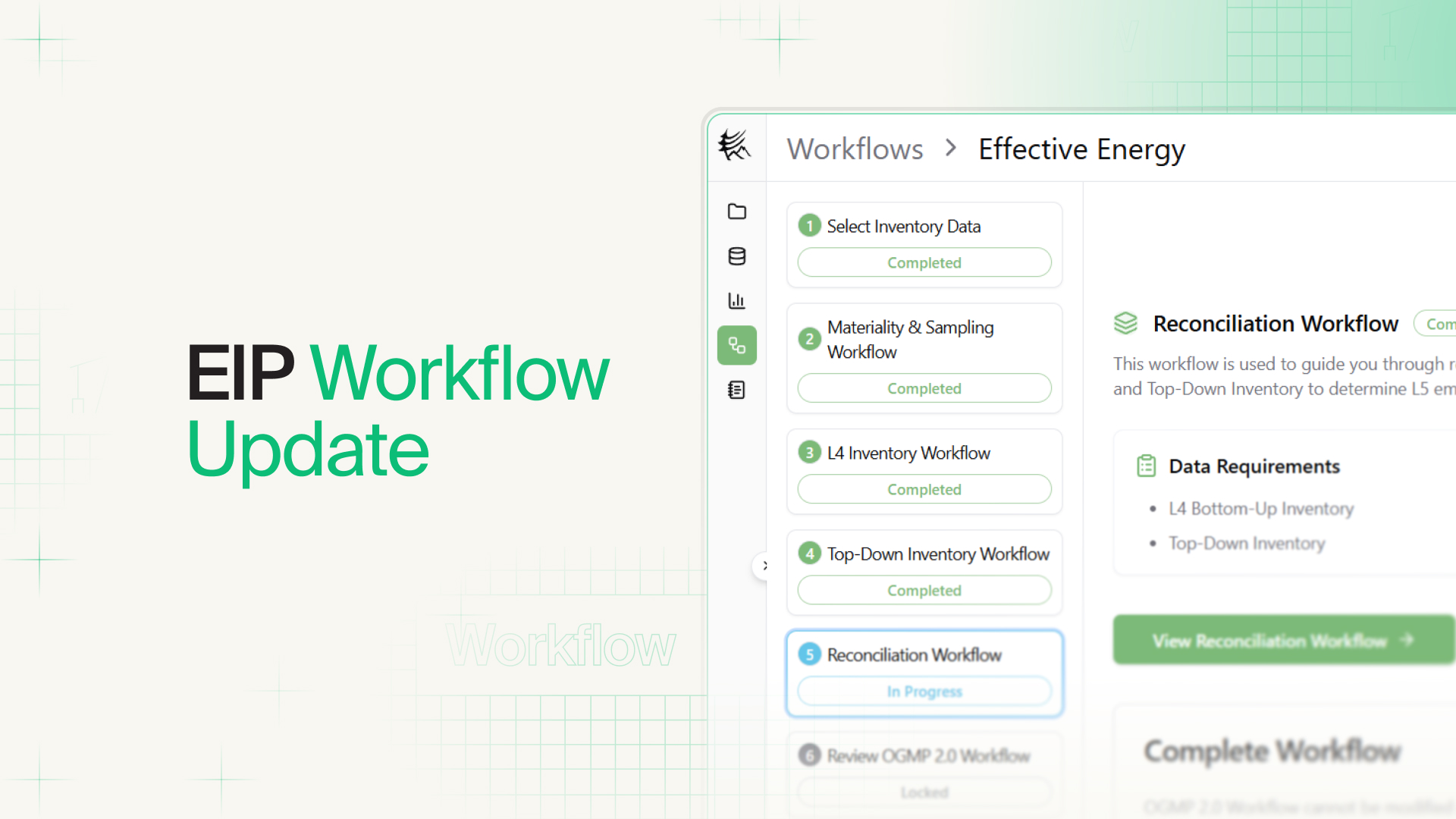

Highwood can support exporters in meeting the evolving “highest standards” in methane measurement required by the EU. We leverage extensive experience with frameworks and protocols such as OGMP 2.0, Veritas, and MiQ. Through the planning and execution of emission reduction initiatives and the development of measurement-informed inventories, Highwood has raised the bar for defensibility and accuracy with our industry-leading Emissions Intelligence Platform (EIP) software.

Contact us to set up a brief chat and learn more.