Highwood Emissions Management Inc. today announced it has secured $3 million in seed funding, led by Energy Capital Ventures (ECV) and supported by Veritec Ventures. This marks the first external funding Highwood has accepted, positioning the company for accelerated growth and innovation in the emissions management market.

Highwood plans to use the investment to further develop and scale its revolutionary Emissions Management Toolkit software platform. Designed to address the evolving challenges faced by the oil and gas industry, the toolkit empowers companies with the tools they need to capitalize on their greenhouse gas emissions management strategies. By providing operators with advanced data tools, Highwood empowers energy companies to achieve climate change objectives by meeting them where they are in their emissions management journey. ECV, the only early-stage venture fund investing in the future of ESG innovation and the digital transformation of the natural gas industry, served as the lead investor in this round. Highwood CEO Jessica Shumlich said ECV’s deep understanding of the industry, combined with their experience and dedicated focus on decarbonization tools, made them an ideal partner. “We were extremely impressed by Highwood’s thought leadership in emissions management and mitigation and their commitment to decarbonization,” said Vic Pascucci III, Managing General Partner at ECV. “With this investment, we are confident in Highwood’s ability to solidify its position as a leading provider of emissions management solutions and continue to drive positive change in the energy sector.”

“We are excited about Highwood’s future as they navigate the emerging challenges of emissions management,” said Krishna Shivram, Managing Partner at Veritec Ventures. “We love Highwood’s focus on the energy industry. Given our extensive background in the energy sector, we believe Veritec can add immense value to continuing product development, customer acquisition, and the overall scaling of the business.”

Funding Milestone will Accelerate Product Development, Talent Acquisition & Partnerships

“This funding round is a significant milestone for Highwood Emissions Management,” said Shumlich. “In order to generate intelligence to inform decision-making, companies need to be able to compile, analyze, and understand the data required for an integrated emissions management solution. We are thrilled to further expand and enhance the Emissions Management Solution, assisting oil and gas companies at every stage of their emissions management journey.”

The seed-stage capital will also be allocated towards expanding Highwood’s teams, accelerating development, and fostering collaboration with industry and academic partners. By investing in talent acquisition and internal growth, Highwood aims to solidify its position as a leading provider of emissions management solutions and continue to innovate in the market.

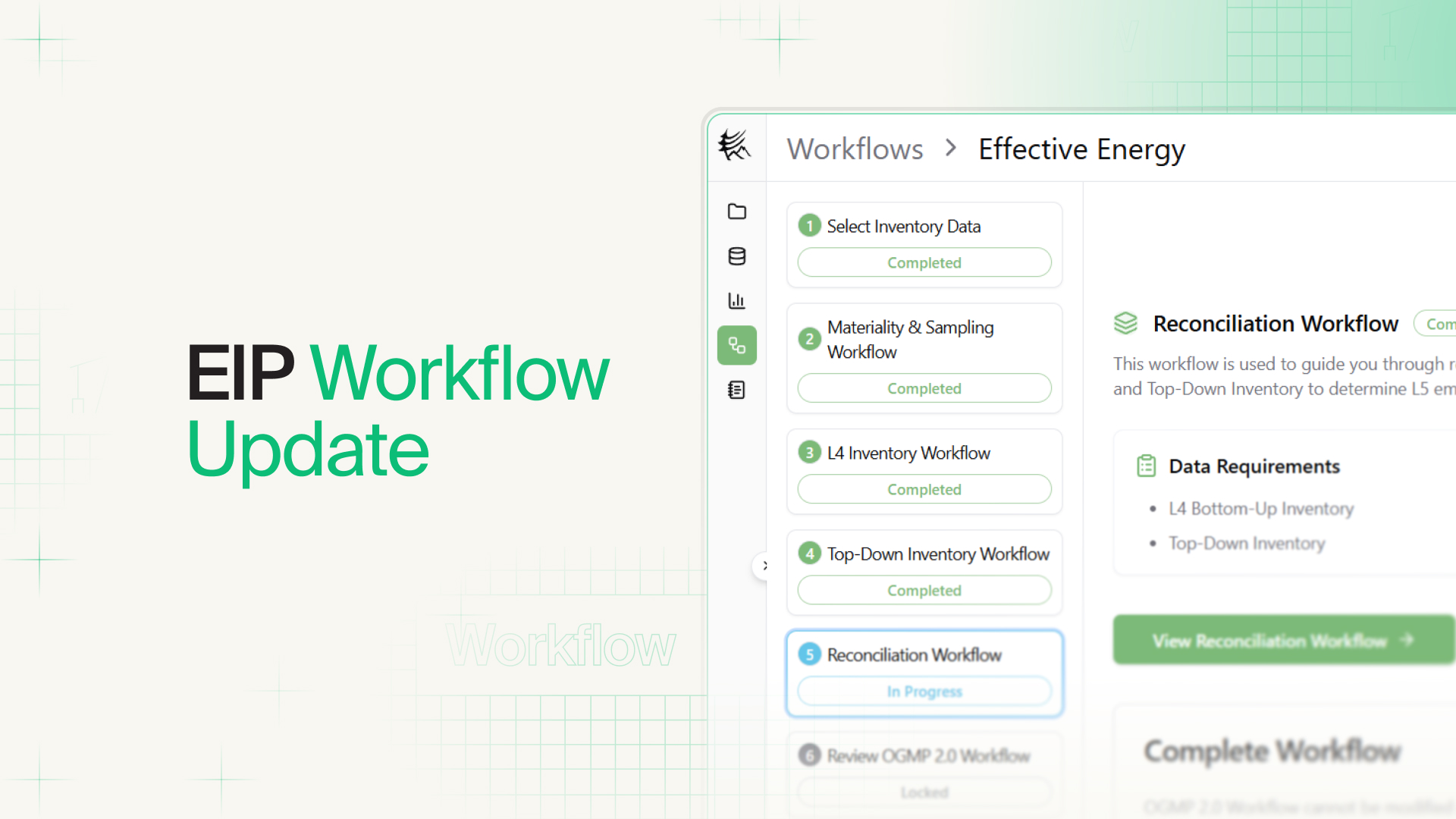

Highwood has already made significant strides in the industry with its commercialized software, including the highly acclaimed Reduction Pathways, which helps companies develop emissions reduction strategies, compare effectiveness, and communicate progress to their emissions targets. Future development will focus on Highwood’s Emissions Insights, an integrated platform that leverages emissions data from diverse sources to improve decision-making and streamline disclosure.

Highwood has actively engaged in noteworthy projects and collaborations, showcasing its involvement in various impactful initiatives. One such collaboration involved providing advisory services to MiQ, a prominent non-profit organization that offers a natural gas certification program, distinguishing operators with low methane emissions from others in the market. Through this partnership, Highwood and MiQ developed a cutting-edge tool that enables operators to assess their methane intensity levels, aiding them in their decision-making before undergoing the formal MiQ certification process.

Moreover, Highwood played a pivotal role as the primary technical consultant for Veritas, GTI Energy’s Methane Emissions Measurement and Verification Initiative. Veritas stands as a groundbreaking project addressing the critical need for reliable and comparable measurement- informed methane emissions intensity in the industry.

The recent successful completion of the seed funding round serves as a testament to Highwood’s forward-thinking approach and commitment to revolutionizing emissions management practices. With esteemed investors such as ECV and Veritec Ventures providing support, Highwood is poised to deliver on its mission of collaborating, innovating, and educating our way to a world with effective and affordable emissions management solutions.

About Highwood Emissions Management Inc.

Highwood Emissions Management is an independent, Calgary-based emissions management software and services firm. Working with industry, government, and innovators around the world, Highwood leverages data, analytics, knowledge, and experience to optimize GHG emissions management. Highwood’s mission is to collaborate, innovate, and educate the way to a world with effective and affordable emissions management solutions. To learn more, visit highwoodemissions.com.

About Energy Capital Ventures (ECV)

Energy Capital Ventures is the only early-stage venture capital firm dedicated to the sustainability, resilience and digital transformation of the natural gas industry. In addition to this unique thesis which makes the firm advocates for innovation in Green Molecules™, ECV further differentiates itself with a customized engagement and deep integration with its corporate limited partners, all of whom are publicly traded utilities. This model enables ECV to provide a platform of innovation, bringing together the technology of the entrepreneurial ecosystem with the scale of the utility industry for generational, game-changing impact. To learn more, visit

www.energycapitalventures.com.

About Veritec Ventures

Veritec Ventures is a venture capital firm investing in energy transition and energy efficiency-enhancing technologies. The firm was founded by an accomplished, multi-disciplinary partnership group made up of recognized leaders in the energy sector. Each of our partners has held prominent roles in industry, finance, or venture, and each possesses decades of experience in energy and more recently energy transition. Our partners bring to bear complementary skill sets, such as executive leadership, operations management,

entrepreneurship, M&A, and corporate finance, contributing to more comprehensive investment evaluation, differentiated post-investment technical advice / operational guidance to portfolio companies, and well-timed and efficiently orchestrated monetizations.

Media Contact

Treble

Lindsly Penny

[email protected]