Update (November 7, 2024): Since the publication of this post, the European Commission has indicated that producers seeking to import oil and gas into the EU may be considered compliant with EU regulations on measuring, monitoring, reporting, and verification if their reporting is equivalent to OGMP 2.0 level 5 requirements and the data is independently verified. For North American energy producers seeking access to EU markets, this provides additional clarity and opportunity for producers incorporating or considering incorporation of measurement informed inventory methodologies to their emissions strategies.

On May 27th, 2024, the European Commission (EC) legislated the world’s first-ever regulation on methane emissions from oil and gas imports. Under the new rules, European Union (EU) oil, gas, and coal companies are required to measure, monitor, report, and verify (MMRV) their methane emissions. The new regulation will gradually apply these same stringent requirements to EU oil, gas, and coal imports,1 requiring incremental compliance2 according to the following timeline:

- 2025: Exporters to the EU must include whether and how they are measuring, reporting, and reducing methane emissions.

- 2027: MMRV processes equivalent to EU producer standards are required on all new import contracts to the EU.

- 2028: Producers must report, by methodology set by the EC,3 the methane intensity of oil, gas, and coal that they are placing on the EU market.

- 2030: Oil, gas, and coal imported into EU market must be below maximum methane intensity values.3

The Risk

As one of the world’s largest oil and gas importers, the new EU methane regulations could be challenging for producers exporting LNG and crude oil to the EU. The EC will require methane MMRV at the “highest monitoring standards”, which includes methane emissions quantification at both site & source level, and independent third-party verification of reporting.

The EC plans to establish and maintain a methane transparency platform, to compare methane performance of EU member states, producers, and importers. The EC plans to establish a global methane monitoring tool and methane transparency database that uses aerial and satellite data to regularly publish information about large emitters of methane from energy sources. Further, the EC plans to set up a super-emitting event rapid alert mechanism, which will utilize satellite data from certified providers (e.g., Copernicus) to make super-emitter information publicly available and notify the countries in which these new super-emissions occur. The EC’s planned super-emitting event rapid alert mechanism is similar to the EPA’s Super Emitter Program, and UNEP’s Methane Alert and Response System.

The US is a top supplier for both LNG and crude oil to the EU. However, US producers seeking to maintain their competitive edge will need to adapt rapidly. The EC will verify and publicly display the methane performance (including satellite detection of super-emitters) of oil and gas imports, putting pressure on US producers to meet the demands of increasingly sustainability-conscious consumers in Europe. Due to the EC’s requirement for methane measurement across the full value chain of imports at the “highest standard”, some US producers may not be eligible to export to the EU as of 2027. The EC’s leveraging of transparency and MMRV will make methane intensities publicly available to consumers by 2028; although less sustainability-conscious EU consumers can continue to choose high methane intensity energy imports, this option is temporary. The EC’s progressive tightening of import rules will close greenwashing pathways, and the EC will impose a maximum methane intensity for oil and gas imports in 2030. Not only will US producers that fail to meet MMRV and associated methane intensity requirements gradually lose competitiveness in the EU, they may be shut out entirely.

The Opportunity

As one of the world’s top importers of oil and gas, the EU has imposed a significant challenge on the global supply. However, US producers are well poised to meet this challenge. EPA’s Subpart-W reporting methodology already goes a long way toward growing reporting requirements, especially with the recent revisions. Colorado has recently adopted a leading emissions verification rule, and both California & New Mexico GHG reporting requirements go beyond EPA’s minimum.

Participation in voluntary initiatives can defensibly and transparently move a producer even closer to meeting the EU’s pending MMRV requirements. Certification by MiQ can prove your methane intensity, the Veritas protocols provide methodologies for building measurement-informed inventories, and achieving OGMP 2.0’s gold standard can take credibility of your reporting to the next level. Although OGMP 2.0 is not specifically required by the EC for EU importers, the EC is advocating for OGMP 2.0 membership, and this new methane regulation “build(s) on the Oil and Gas Methane Partnership 2.0 (OGMP 2.0) framework”. Uptake of these voluntary initiatives by US producers is already significant, and expected to continue growing. By combining regulatory reporting and voluntary initiative participation with expertise in transparency, verification, and defensibility, US producers can have a strong first mover advantage in Europe’s new energy import economy, and continue to displace Europe’s reliance on Russian oil and gas.

Highwood Can Help

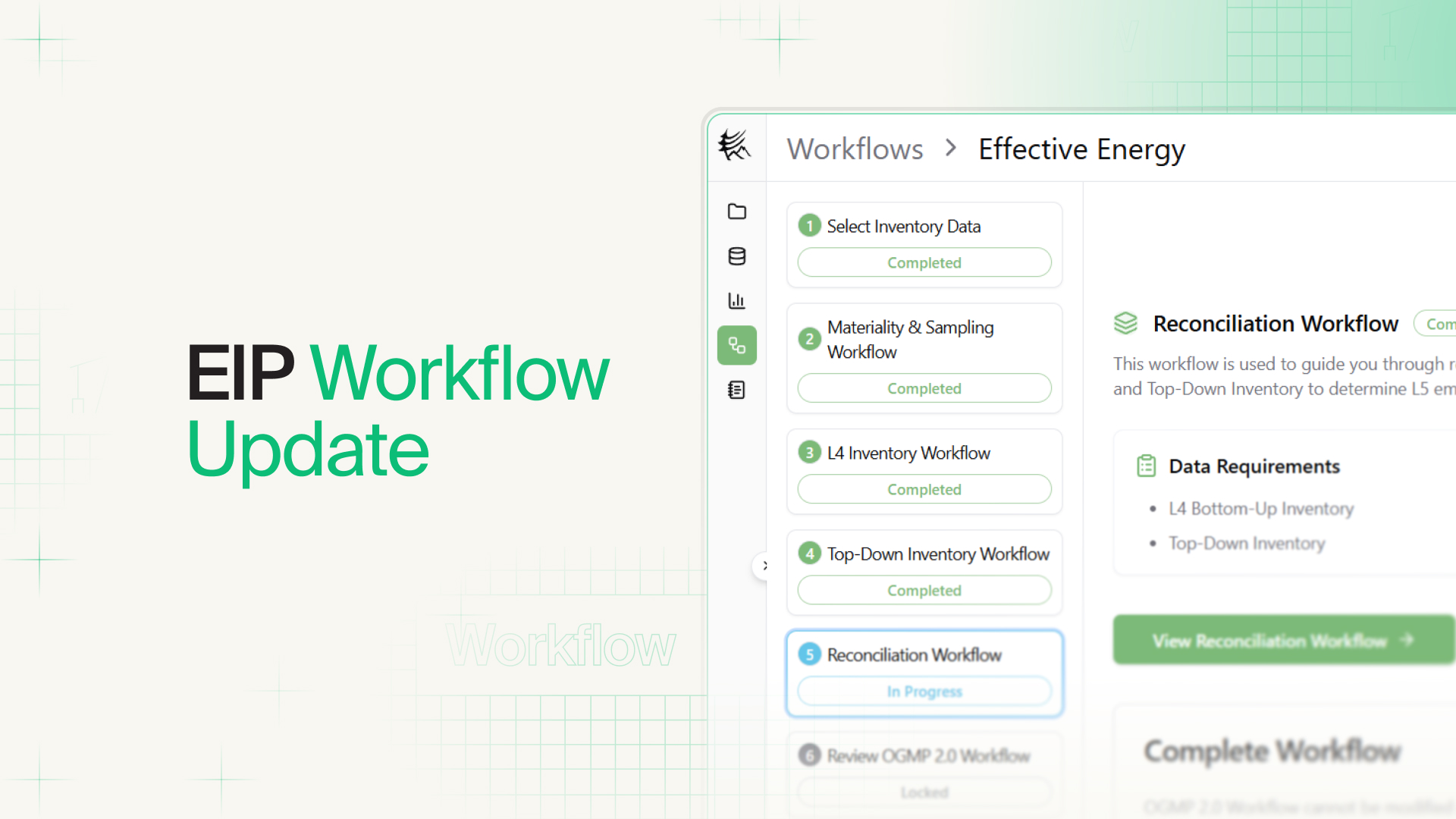

Although US members of voluntary initiatives are already progressing toward meeting Europe’s pending MMRV requirements, the definition of the “highest standard” in methane measurement required by the EC will evolve over the coming years. Highwood specializes in helping our clients reach high standards in methane emissions, through our experience in the planning and ongoing execution of emission reduction initiatives and reporting that are compliant with frameworks/protocols such as OGMP 2.0, Veritas and MiQ. Further, we have now leveraged our unmatched expertise in measurement-informed inventories to develop industry leading software, pushing the highest standards in defensibility of emissions reductions even higher.

Contact us to set up a brief chat and learn more.

1 The regulation will progressively introduce more stringent requirements to ensure that exporters gradually apply the same monitoring, reporting and verification obligations as EU operators.

2 To preserve security of supply, failure to meet the requirements of the regulation will not lead to an import ban on oil, gas, or coal to the EU market. Instead, a system of penalties, for example, periodic penalty payments or fines will be put in place and enforced by the Member States for infringements of this regulation. Penalties will have to be set by the national authorities in the Member States at levels that are effective, proportionate, and dissuasive.

3 To be later set out by the European Commission in secondary legislation.