Report • September 2023

Voluntary Emissions Reduction Initiatives in 2023

Share this report

Authors and Acknowledgements

Authors

Heather Isidoro, P.Eng, MBA

Senior Consultant, Voluntary Emissions

Highwood Emissions Management

Antonio Monisit

Differentiated Gas Technologist

Highwood Emissions Management

Katherine Elona

Emissions Engineer-In-Training

Highwood Emissions Management

Jessica Shumlich

Chief Executive Officer

Highwood Emissions Management

Paul Ashford, P.Eng.

Vice President Consulting

Highwood Emissions Management

Dr. Thomas Fox

President & Chief Innovation Officer

Highwood Emissions Management

Dr. Jeff Rutherford

Director, Research & Development

Highwood Emissions Management

Sponsors and Acknowledgements

As we launch the third edition of our annual Voluntary Initiatives report, I am filled at once with wonder and gratitude. Wonder at how far our industry has come in only three years, in terms of our collective emissions knowledge, competencies, and sustained commitment to progress. Gratitude for those who have done the work to get us here – including industry, regulators, academics, non-profits, service providers, innovators, and educators. Many of the visionaries pushing our industry forward are the same individuals and organizations who have made this report possible. We extend our sincere thanks to our sponsors for funding this report, to the administering organizations for their cooperation and contributions, to our colleagues and mentors for their guidance, and to the Highwood team – especially those who have worked tirelessly for months to produce this report. We look forward to another year of hard work – alongside all of you – in our mission to deliver cleaner and more affordable energy.

Dr. Thomas Fox

President & Chief Innovation Officer

Highwood Emissions Management

Executive Summary

Global demand for energy continues to increase, alongside energy transition pressure. With a rising global demand for sustainable and affordable energy, operators in the oil and gas industry are looking for strategies to balance or reduce the greenhouse gas (GHG) emissions footprint from their operations. As a large global emitter, the oil and gas industry is expected to contribute to GHG emission reductions to meet the goals set by the 2015 Paris Agreement.

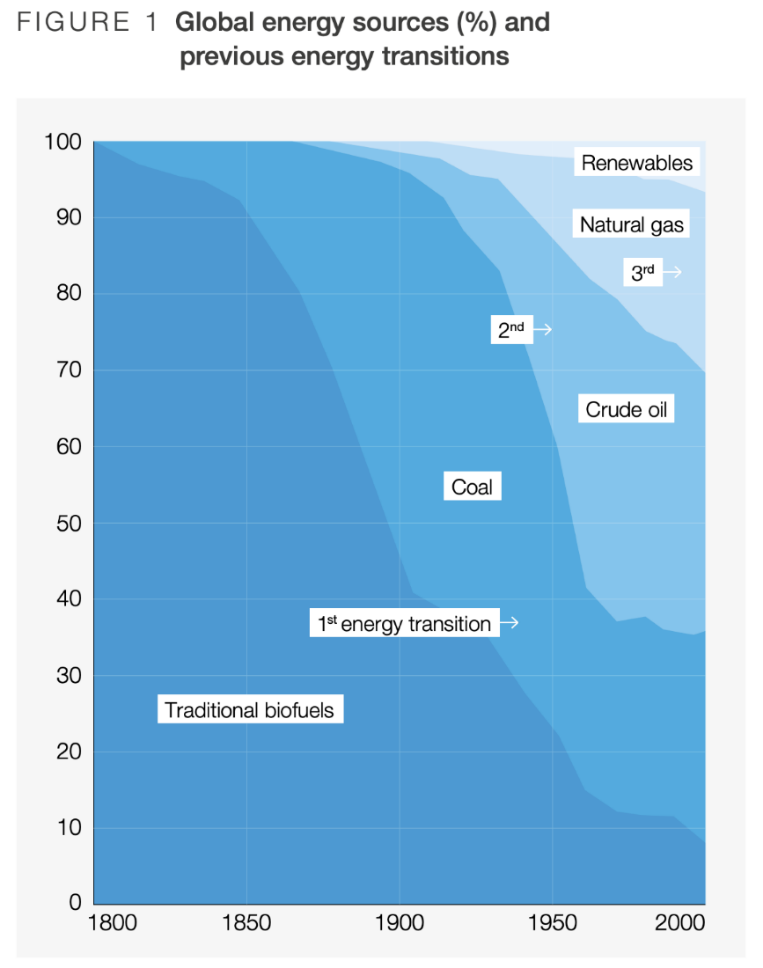

Energy transition is often misunderstood. Throughout history, transitions have occurred due to technological developments, or scarcity of existing resources. Today’s energy transition factors in environmental concerns and the need to mitigate climate change. However, transition is not about a hard-stop on existing energy sources, but rather a collaborative approach to lowering the carbon footprint of existing supply in conjunction with the development of new low-carbon solutions.

The energy industry will be part of the solution. Minimizing and managing emissions from oil and gas production is not only becoming a regulatory requirement, but also a benchmark for stakeholders to evaluate and grant social license. By taking a proactive approach to emissions management and going beyond the minimum regulatory requirements, energy companies can differentiate themselves to Environmental, Social, and Governance (ESG) conscious stakeholders, profit from reduced leakage, as well as benefit from premiums for certified low-carbon products.

Voluntary Initiatives are an essential part of the solution. Early in 2021, our team at Highwood Emissions Management (Highwood) observed a rapidly growing ecosystem of voluntary initiatives available to the energy industry. Our clients expressed increasing confusion as they attempted to navigate a new and expanding network of programs, asking questions like “Which one is best?” and “What is the benefit to my organization?”.

Our first report in 2021 broke new ground. It brought structure and guidance to the rapidly emerging voluntary initiatives landscape. We identified 20 distinct voluntary initiatives and categorized them as certifications, guidelines, commitments, or ESG ratings. We also introduced disclosure levels and offered recommendations for how organizations could approach and adopt voluntary initiatives. These definitions and classifications are rapidly becoming standardized terms in the emissions management space.

We followed with our 2022 report, expanding our coverage to 24 voluntary initiatives available to the energy industry, including 8 new initiatives. The second edition leveraged questionnaires to collect detailed information from administering organizations. Using this data, we expanded the scope to include the entire supply chain, allowing participation for gathering, boosting, processing, transmission, and LNG operations. We also introduced a series of feature articles to help operators evaluate their voluntary options, with topics such as The Role of Measurement, Selecting the Right Initiative for You, Leaders in Differentiated Gas, and more.

This 2023 third edition updates existing and new programs, totalling 24 voluntary initiatives now available to the energy industry across the supply chain. New developments are highlighted as well as trends towards the use of shared methodologies and protocols among initiatives and regulatory bodies.

In 2022, there was a surge of adoption in most certification initiatives.

Most of these initiatives currently have a slow but steady rate of continued growth. OGMP 2.0 and MiQ are outliers, with 86% and 29% increase in number of listed participants, respectively.

Contrary to our expectations, we have found that less rigorous initiatives did not correlate to a higher uptake. Based on the data gathered, initiatives that rated themselves as moderate in the effort scale had the highest increase in uptake in 2023. This indicates that companies are willing to concentrate their effort on initiatives that have established their interoperability and value add, be it in terms of financial, operational and/or reputational value.

We also observed that most initiatives require or award higher ratings to companies employing direct emissions measurements. An Eye on Methane: International Methane Emissions Observatory 2022 Report noted direct measurement numbers were on average, 60% higher than industry estimation for United States energy production.

Key findings:

What has changed since 2022?

01. Participation is growing and seen across the world, especially for OGMP 2.0.

02. Most initiatives have acknowledged their complementary criteria with other programs, increasing interoperability and agility for participants.

03. Some regulatory bodies have started to structure their disclosure requirements around voluntary initiatives to streamline and maximize interoperability.

04. Measurement and reconciliation are now encouraged by multiple initiatives. ‘Measurement-informed inventories are gaining traction.’

05. Participating companies are facing heightened public scrutiny regarding their environmental claims, prompting administering organizations to improve on verifiability and transparency.

06. Newer initiatives are developing guidance for specific industries and segments.

While the cost of direct measurement is higher, measurement-informed inventories tend to better represent individual company inventories. Companies using direct measurement have more representative baselines giving higher credibility to their overall reduction results.

As many organizations still struggle to meet minimum regulatory requirements, there is hesitation to add voluntary initiatives when the cost and effort level is not well understood.

We identify six key knowledge gaps that may prevent broader industry uptake. Addressing these gaps and aligning protocols will improve transparency, credibility, and the value of voluntary initiatives.

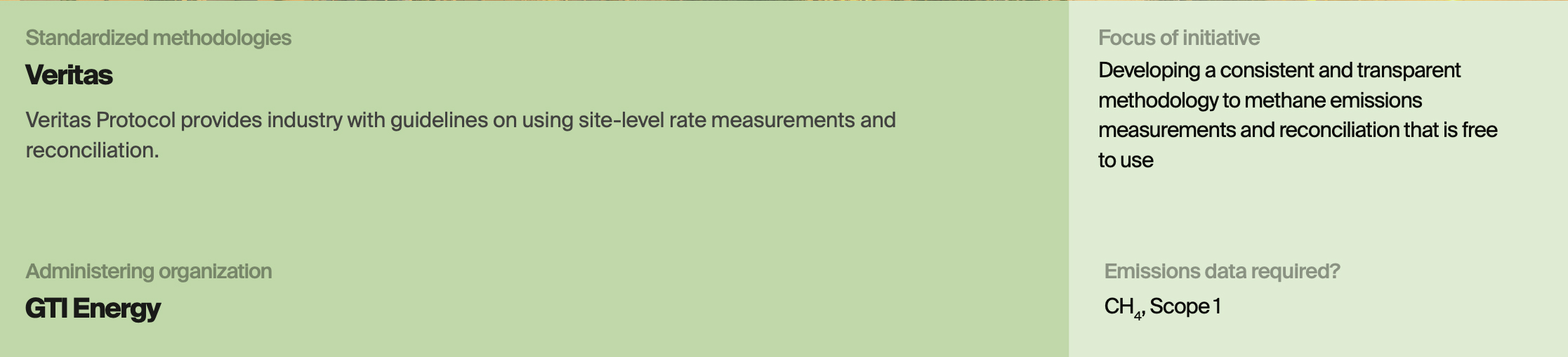

In addition, we continue to address the knowledge gaps identified in the 2022 report. In particular, GTI Energy’s Veritas initiative has addressed the need for better data and more transparent reporting by creating methane measurement and reconciliation protocols. Amid continuous improvement, clarification, and recognition, we are optimistic that voluntary initiatives will become increasingly credible, trusted, and adopted within the oil and gas.

Key Knowledge Gaps

01. Harmonization between regulations and voluntary initiatives – Will initiatives adopt regulatory disclosure requirements, or the other way around? The alignment in their requirements will decrease the barriers in adoption of voluntary initiatives.

02. Chicken and egg conundrum: A major barrier in the adoption of certification and commitment initiatives has been the uncertainty around the benefits versus costs. However, a wide adoption of the initiative must happen to decrease this uncertainty.

03. How can administering organizations encourage transparency and accountability without dissuading companies from engaging in the programs?

04. What is the level of effort required and best approach for a credible measurement-informed inventory?

05. Encouraging companies to delve deeper into understanding their complete emissions profile through direct measurement remains to be a significant challenge.

06. There is no centralized and publicly accessible database that collects, aggregates, and analyzes information from the different initiatives. Is there a meta-initiative that can collect, aggregate, and disseminate reported data?

We conclude with a set of recommendations from Highwood to guide stakeholders as we collaboratively move to address existing knowledge gaps, strengthen credibility, increase uptake, and realize clearer benefits to participation.

- Administering organizations must capitalize on successes by quantifying the benefits of participation, not only to encourage potential participants but also to identify opportunities for alignment with similar initiatives.

- All stakeholders should continue to collaborate, establish alignments, and work towards consolidation of complementary programs to provide companies the agility to participate in multiple initiatives using the same set of data.

- Administering organizations should continue promoting transparency and move towards requiring independent verification to increase the credibility of their programs, shield participants from possible allegations of greenwashing, and enhance stakeholder confidence.

- The energy industry should lead by example and promote better emissions quantification, reporting, and mitigation to provide a new benchmark for other industries.

Introduction

When we look at the big picture of climate change and GHG reduction targets, it is worth making a few distinctions about the overall GHG picture.

GHG’s are gases that trap heat in the atmosphere, and include carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and fluorinated gases. Carbon dioxide and methane account for approximately 80% and 12% of total GHG’s respectively.

CO2 is produced by the combustion of fossil fuels or, in other words, the use of fossil fuels to create energy. Methane is produced during fossil fuel extraction (coal, gas, and oil), agricultural practices, land use, and by the decay of organic landfill waste.

Energy producers (including coal) are responsible for 40% of emissions, second only to agriculture2.

Year over year methane emissions from energy combustion, leaks, and venting grew by 3% and 2% in 2021 and 2022 respectively1. Methane emissions are both harmful, and wasteful. The International Energy Agency (IEA) estimates that:

“More than 260 billion cubic metres (bcm) of natural gas is wasted through flaring and methane leaks globally today. It is unlikely that all of this can be avoided, but with the right policies and on-the-ground implementation on both flaring and methane emissions, an estimated 200 bcm of additional gas could be brought to markets.1 ”

In 2022 the average Henry Hub gas price was US$ 6.40/MMBTU. Using an average heat content of 1,037 BTU/cf, and 1 cf to 0.02833 m3, 1 bcm of natural gas is equal to 36,600,000 MMBTU. An additional 200 bcm could potentially translate to US$ 4.6 trillion in additional revenue.

What to expect in the 2023 report?

01. Expanded analysis to include 3 new initiatives: Basinwide, Project Canary Low Methane Rating Protocol, and IFRS S1 and S2.

02. Full analysis coverage of initiatives across the entire supply chain, including gathering and boosting, processing, transmission, liquified natural gas (LNG), and distribution.

03. Comprehensive evaluations of new each initiative based on emissions reporting and public disclosure requirements, as well as its methodology transparency.

04. Year over year updates to existing initiatives noting changes or improvements against a consistent evaluation criterion.

05. Data driven results based on a survey of administering organizations, publicly available data, and published methodologies.

06. A series of feature articles on current trends and emerging paradigms, including:

a. Technology-driven developments and the adoption of measurements in carbon accounting.

Author: Dr. Thomas Fox, President & Chief Innovation Officer

b. What’s in it for Me? Natural Gas Voluntary Initiatives for Emissions Reductions.

Author: Paul Ashford P.Eng., Vice President of Consulting

c. Creating a demand-driven market for certified gas – the MiQ/Highwood index.

Author: Dr. Jeff Rutherford, Director of Research & Development

d. Balancing Access Against Climate Objectives.

Author: Heather Isidoro P.Eng., Senior Consultant, Voluntary Initiatives

Methane has a significant impact on climate change.

While methane emissions from energy production are a fraction of carbon dioxide emissions, reduction of methane emissions can have a proportionately bigger impact that an equivalent reduction of carbon dioxide. In the atmosphere methane has a lifespan of 12 years, while carbon dioxide (CO2) can last for centuries. However, methane (CH4) has a much higher radioactive efficiency, or ability to absorb energy. When compared to carbon dioxide as a baseline, the Environmental Protection Agency (EPA) assigns a Global Warming Potential (GWP). The larger the GWP, the more significant the impact is on climate change. Methane has a GWP of 27-30 over 100 years, and 81-83 over 20 years, meaning the impact of methane reductions now can be 27-83 times more impactful than carbon dioxide reductions.

There continues to be a large gap in emissions management.

Many organizations continue to only meet the minimum regulatory requirements. Other organizations have scaled back from earlier announcements on energy transition and renewables to return to an emphasis on organic growth and sustainable cash flow. What will be the long-term cost of falling behind, or continuing to only meet the minimum regulatory requirements? Which strategy will ensure long-term stakeholder returns? For organizations that do choose to go beyond regulatory requirements, and prioritize strong ESG performance, what mechanisms are in place to help them stand out from their competitors, and give them an opportunity to showcase their performance?

Voluntary Initiatives are in the news and are represented on panels at every energy conference – but what are they, and why are companies doing them?

Voluntary Initiatives provide the tools, support, frameworks, and markets for companies to set and realize the benefits of targets that go beyond the baseline.

While the benefits to industry can be intangible or uncertain at this time, innovative and streamlined technologies are making it easier for companies to build emissions management into day-to-day operations and be recognized for it, thus turning participation in voluntary initiatives into a powerful business driver.

The energy industry can be a substantial contributor to the climate change solution.

As methodologies improve and routine public disclosure becomes standardized, the benefits of Voluntary Initiatives will become more apparent and quantifiable. As stakeholders, including energy buyers and ESG conscious investors, continue to prioritize ESG alongside profit, organizations that go above and beyond minimum regulatory requirements will be rewarded. As standards and initiatives provide clearer paths and benefits, we expect Voluntary Initiative participation to increase as the industry works towards a shared vision of responsible energy.

In our 2021 and 2022 reports, we gave structure to the complex world of emissions reduction and Voluntary Initiatives.

Expanding on that structure in this 2023 report, we update the list of initiatives, perform new analyses, and deliver fresh insights. With so many Voluntary Initiatives to choose from, navigating the nuances and requirements to determine which initiative aligns with your corporate goals can be daunting. Our aim is to facilitate informed decision making on adoption of these initiatives by revealing their benefits and program particulars in an unbiased manner, making it easier for organizations to map out their emissions management journeys.

We continue to see perpetual change and development from year to year.

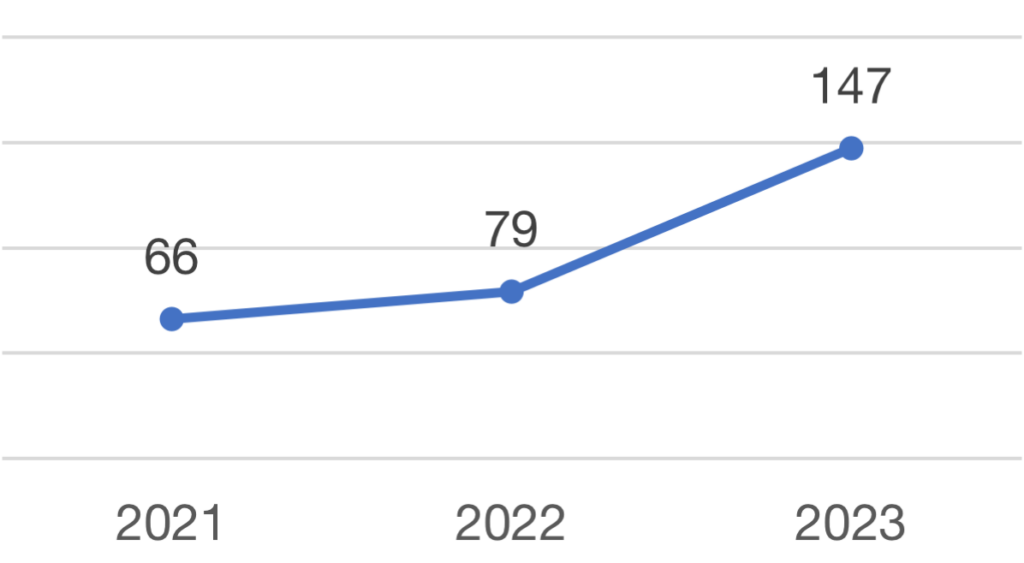

Our 2022 Voluntary Initiatives Report highlighted an increase in uptake for differentiated gas certification programs, such as MiQ and EO100. Similar trends have been observed for most other voluntary emissions reduction initiatives. While the rate of uptake is relatively high across the board, no single program compares to OGMP 2.0’s growth in the past two years: increasing from 66 companies in 2021 to 147 in 2023. Regulators, such as the Colorado Department of Public Health and Environment (CDPHE), are moving towards measurement-informed methane reporting and targets and are looking to harmonize their requirements with those of leading voluntary initiatives.

Please reach out with your questions, feedback, thoughts, or suggestions – we will listen as we continue to guide the industry through initiatives that reward industry for strong emissions performance.

Glossary

The Highwood Glossary proposes a standard set of terms and definitions to help industry, regulators, innovators, and academics in different parts of the world speak the same language.

Administering organization

The entity responsible for running a voluntary initiative and managing participation.

Aggregated data

Emissions data that has been collected from multiple sources and summarized, usually for the purpose of public reporting or statistical analysis.

Agility

The ability to participate in multiple initiatives with lesser effort, often resulting from the interoperability of the initiatives

Audit

The verification of a participant’s data, practices, or performance by an entity other than the participant in question.

Auditable

Designed to enable verification of a participant’s progress towards a goal or adherence to a voluntary initiative by an administering organization or independent third party.

Binding

A voluntary initiative that incorporates compliance measures.

Bottom-up inventory

An aggregate emission rate estimate achieved by multiplying activity factors (counts of components, equipment, or throughput) by emission factors (estimates of gas-loss rates per unit of activity). The vast majority of bottom-up inventories use emission factors derived from industry averages rather than measurements specific to the company. Bottom-up inventory emission rate estimates are consistently lower than site-level and regional emissions measurements in academic research. We avoid the term ‘top-down measurement’ in this report as it is imprecise and often leads to confusion.

Certification

An initiative that holds participants to binding standards that may include emissions reduction performance targets, use of specific technologies, and/or adoption of methodologies. Certifications entail an explicit declaration of achievement from the administering organization to the participant.

Differentiated product

A product (e.g., natural gas) that is distinguished from others on the basis of some attribute (e.g., emissions intensity), making it more attractive to a particular market.

Disclosure

The act of releasing information to a target audience.

Disclosure Level

A novel measure of disclosure for voluntary initiatives developed for this report.

Engagement

A measure of the extent of participation in a voluntary initiative.

Emissions

Greenhouse gas emissions, particularly carbon dioxide, methane, and nitrous oxides.

ESG Suite

Initiatives that entail the full spectrum of reporting on Environmental, Social, and Governance topics.

GHG Protocol

An emissions quantification framework that is widely used by businesses, industry associations, NGOs, and other organizations. Some initiatives use the GHG Protocol for their emissions quantification requirements. GHG Protocol has published several standards, but is recognized for these two emission quantification guidelines:

- Corporate Standard – for scope 1, 2, and energy-related scope 3

- Corporate Value Chain (Scope 3) Standard – for life-cycle emissions, both upstream and downstream

Greenwashing

Fostering an image of ecological responsibility that does not necessarily match, or only partially correlates, to the content of the communications transmitted.

Guidelines

A set of frameworks, standards, principles, and/or tools designed to assist participants in meeting their goals and reporting on their progress.

Interoperability

An initiative indicating that using other initiatives’ methodologies, data sets, and/or ratings and results to meet its own requirements are said to be interoperable with that other initiative. This often allows participants to be agile (see Agility).

Measurement

Acquiring emissions data directly from the environment at a specific place and time.

Net-zero

Pertaining to emissions, achieving a state where either no greenhouse gases are emitted, or remaining emissions are offset through other actions or technologies that can capture or remove carbon from the atmosphere.

Reconciliation

Greenhouse gas emissions can be estimated using emissions factors, measurements, or engineering equations at various spatial and temporal scales. Reconciliation explores whether and why different estimation approaches vary. In some cases, reconciliation can be defined as a methodology for combining multiple different estimates into a single stronger estimate.

Regulatory reporting

Mandatory submission of emissions data to a government body.

Participant

Any company, organization, institution, regulatory body, or other entity that participates in a voluntary initiative.

Responsible gas

Natural gas that meets standards set out in a voluntary initiative. Note that the precise definition of responsible gas is not consistent across initiatives.

Scope 1 emissions

Scope 1 or direct emissions are those emissions arising from sources owned or controlled by an organization within a defined boundary.

Scope 2 emissions

Scope 2 emissions are indirect emissions from the generation of purchased energy, from a utility provider.

Scope 3 emissions

Scope 3 emissions are all indirect emissions – not included in scope 2 – that occur in the value chain of the reporting company, including both upstream and downstream emissions.

Supply chain

Also referred to as the energy value chain, the sequential segments of product flow from initial production through end use. For gas production, the segments commonly include production, gathering and boosting, processing, transmission, storage, distribution, and possibly LNG liquefaction, shipping, and regassification.

Transparency

The degree to which an initiative or participant discloses their internal operations and standards and allows for accessibility of information regarding an initiative.

Value chain

See “Supply chain”

Voluntary initiative

A coordinated effort managed by an administering organization that enables participants to take standardized voluntary steps towards targeting, achieving, and/or taking credit for emissions reductions.

Feature Articles

Technology-driven Developments and the Adoption of Measurements in Carbon Accounting

Dr. Thomas Fox

President and Chief Innovation Officer

Highwood Emissions Management

Methane Monitoring Innovation is Exploding

Over the past decade, the field of methane emissions monitoring has undergone rapid and diverse technological advancements. What began with a few handheld solutions has now expanded to encompass an array of novel methods, including drones, continuous monitors, satellites, aircraft, and even vehicle-based systems. Highwood Emissions Management, a recognized authority in this domain, has been tracking and assessing these evolving solutions through rigorous field testing and simulation modeling. Our proprietary database presently catalogues more than 200 commercially available methane detection and quantification technologies.

Each time you blink, these technologies become increasingly diverse. They exhibit significant variations in spatial and temporal resolution, methane sensitivity, environmental constraints, reliability of performance testing outcomes, and data characteristics. These discrepancies highlight the complexity of emissions monitoring and pose both challenges and opportunities for those engaged in carbon accounting.

The Shift from Leak Detection to Quantification

Historically, methane monitoring technologies have predominantly served Leak Detection and Repair (LDAR) programs, aimed at promptly identifying and addressing leaks. However, a trend has emerged in recent years, marked by a transition from leak detection to a more comprehensive approach involving emission rate quantification.

Emission rates are calculated by extrapolating from samples across spatial and temporal dimensions, thereby estimating a company’s total emissions over a given period. While the science behind these estimations is relatively novel and characterized by large uncertainties, regulatory bodies such as the Colorado Department of Public Health and Environment (CDPHE) and the Environmental Protection Agency (EPA), along with initiatives like OGMP 2.0, MiQ, and Veritas, are increasingly mandating the collection and reporting of emission rate estimates derived from top-down measurements.

Solving Reconciliation Will Be Key to Progress

As the adoption of measurement-based emission rate estimates gains traction, the challenge of comparing and combining disparate datasets will grow. Despite the rise of direct measurement, it’s widely acknowledged that such data has inherent limitations, leading to the need for reconciliation.

Reconciliation involves the integration or comparison of measurement data with bottom-up inventories, the specifics of which vary based on regulatory standards or voluntary initiatives. The goal is to harness the strengths of both measurement data and traditional inventories, leading to more accurate, comprehensive measurement-informed inventories.

The increasing prevalence of measurement-informed inventories underscores the urgency for operators to develop expertise in handling measurement data and reconciling it with bottom-up inventories. A significant outcome of this reconciliation process is the potential of higher estimates of annualized methane emissions. This discrepancy arises due to the tendency of bottom-up inventories to consistently underreport emissions, particularly within the production and midstream sectors.

Conclusion

The convergence of technological innovations and carbon accounting practices has generated a dynamic and transformative landscape. From the proliferation of methane monitoring solutions to the significant shift from leak detection to quantification and the pivotal role of reconciliation, these developments underscore the evolving nature of carbon accounting. As stakeholders navigate new opportunities and obligations, embracing innovation while mastering the intricacies of measurement data and reconciliation will empower energy companies to thrive amid a transforming energy economy.

Natural Gas Voluntary Initiatives for Emissions Reductions: What's in it for Me?

Paul Ashford

P. Eng., Vice President of Consulting

Highwood Emissions Management

With growing concerns about climate change and GHG emissions, companies in the energy industry are increasingly exploring voluntary initiatives for emissions reductions. While regulatory requirements set minimum standards for each jurisdiction, companies that go beyond these requirements can reap numerous benefits, and voluntary initiatives for emissions reductions have gained momentum. This special feature explores why a company that to date has followed a minimum regulatory compliance approach should be interested in voluntary initiatives, whether such initiatives are becoming table stakes, and what the future holds for the industry.

License to Operate

In many jurisdictions, gas producers are required to obtain and maintain licenses to operate. Regulators assess a company’s compliance with environmental regulations, social impacts, and sustainability practices when granting and renewing these licenses. By engaging in voluntary initiatives for emissions reductions, gas producers demonstrate their commitment to exceeding regulatory requirements, strengthening their position for obtaining or maintaining operational licenses. By showcasing proactive efforts to mitigate environmental impact, companies align with regulatory expectations for responsible operations.

The investment landscape is increasingly considering ESG factors. Many investors, including institutional funds and asset managers, prioritize investing in companies that demonstrate strong ESG practices and are growing increasingly savvy in their expectations for tangible demonstration of minimized environmental impact. Securities regulators in the United States and Canada are proposing mandatory emissions disclosure for publicly traded companies. Participating in voluntary initiatives for emissions reductions can showcase a gas producer’s commitment to sustainability and responsible business practices, making it more attractive to ESG-focused investors. This, in turn, can lead to increased investment opportunities, access to green capital, and potentially lower cost of capital. Companies that proactively address environmental impact are seen as more resilient and better equipped to navigate the transition to a low-carbon economy, making them attractive to long-term investors.

Insurance companies are increasingly factoring in environmental risks when underwriting policies. By actively participating in voluntary initiatives for emissions reductions, gas producers demonstrate their commitment to environmental stewardship. This can lead to more favorable insurance terms, including lower premiums, as insurers perceive lower risk associated with companies that prioritize sustainability. Additionally, demonstrating proactive measures to manage emissions can reduce the risk of future environmental liabilities, further enhancing insurability.

Competitive Advantage

In today’s market, sustainability and responsible business practices have become key differentiators. Consumers are increasingly considering the environmental impact of the products and services they choose. By participating in voluntary initiatives for emissions reductions, companies will position themselves as leaders in the industry, gaining a competitive edge over peers who only meet the minimum requirements.

As sustainability becomes a significant factor in consumer purchasing decisions, companies that exceed minimum regulatory requirements can differentiate themselves in the market. By highlighting their commitment and progress on emissions reductions, gas producers can attract environmentally conscious customers. This creates brand loyalty and positive brand perception, furthering their competitive advantage over those who have not made similar commitments.

The potential to receive premium pricing for low-methane gas has been touted as an additional benefit for several certification initiatives. While we have seen instances of premium pricing on bilateral marketing contracts, there has yet to be widespread evidence of premium pricing for certified gas. There is possibility for greater instances of premium pricing as consumers and purchasers begin to value and demand energy that is produced to the highest environmental standards.

Preparedness for Stronger Regulations

Voluntary initiatives for emissions reductions are becoming increasingly important in the context of the evolving energy landscape. Governments, businesses, and consumers are demanding greater action to combat climate change and reduce GHG emissions. As a result, regulatory requirements are expected to become more stringent in the future.

By embracing voluntary initiatives today, gas producers can prepare for a future where emissions reductions and sustainability are the norm. Investing in cleaner technologies, optimizing operational processes, and adopting innovative approaches can help companies stay ahead of regulatory changes, meet evolving stakeholder demands, and future-proof their business.

Moreover, the transition to a low-carbon economy presents opportunities for innovation and collaboration. Gas producers that actively engage in voluntary initiatives can contribute to industry-wide knowledge sharing and technology advancements. By working together, the industry can develop and deploy more sustainable practices, driving the transition to a cleaner energy future.

Enhanced Reputation & Mitigation of Reputational Risk

An intangible benefit for companies participating in voluntary initiatives can be the positive impact on their reputation. Investors are increasingly factoring ESG criteria into their decision-making process. By actively participating in voluntary initiatives, gas producers can attract ESG-focused investors and access funding opportunities that may not be available to companies that only meet minimum regulatory requirements.

By voluntarily exceeding regulatory requirements, companies can showcase their commitment to sustainability and environmental stewardship and contribute in a tangible way to global efforts to combat climate change. This can further enhance a gas producer’s reputation by showcasing their willingness to proactively addressing emissions management and reductions, companies will position themselves as leaders in the industry, enhancing reputation and credibility. It aligns and builds trust with the increasing expectations of consumers, investors, and stakeholders who prioritize sustainability and responsible business practices.

Conclusion

In conclusion, voluntary initiatives for emissions reductions offer numerous benefits to gas producers. From enhancing reputation and gaining a competitive advantage to accessing new markets and investment opportunities, there are clear incentives for companies to go beyond the minimum regulatory requirements. By actively participating in voluntary initiatives today, gas producers can position themselves as leaders in sustainability, contributing to a greener future and ensuring long-term success in a rapidly evolving energy landscape.

Creating a Demand-driven Market for Certified Gas – The MiQ/Highwood Index

Dr. Jeff Rutherford

Director of Research & Development,

Highwood Emissions Management

In countries like the United States and Canada, operators are required to disclose methane emissions via government-led reporting programs (i.e. U.S. Greenhouse Gas Reporting Program). Over the past decade, studies based on novel methane measurement technologies have revealed potential inaccuracies in government-led programs, often a significant downward bias. This has eroded trust among gas buyers and the public in government-led reporting programs and the natural gas industry in general.

Third-party Certification

Third party certifiers such as MiQ, Equitable Origin, and Project Canary’s TrustWell provide alternative avenues for natural gas operators to report methane emissions and other environmental attributes of their operations. In theory, gas volumes certified by third-party programs will be more attractive to ESG-conscious investors and buyers. As ESG pressures mount, and pending significant improvements in government-led reporting, natural gas operators are incentivized to improve operational efficiency. Those with the highest environmental performance, lowest methane emissions, and emission reductions will be selected above others.

What level of methane emissions from a natural gas operator should be considered strong environmental performance? This relates to a general challenge in environmental certification programs, which is setting a benchmark and determining what is good, better, or worse than the average. Credible, reproducible benchmarks are also critical in any financial instrument, much like the S&P 500, for backing performance claims and any resulting financial transactions.

To date, assessing overall industry average methane emissions has been complicated by the breadth of the industry, difficulties in measuring at a large enough scale, and the varying nature of methane emissions sources. In the United States alone, assessing >1 million wells, millions of miles of pipeline, and hundreds of processing and transportation facilities is an enormous undertaking. The U.S. Environmental Protection Agency’s Greenhouse Gas Inventory is the most often used as an industry baseline, however, as mentioned above, this underestimates emissions in many cases. A low baseline derived from inaccurate emission factors disincentivizes participation in voluntary initiatives by underestimating the benefits to high-performing operators and those that chose to quantify and disclose their emissions more fully.

The MiQ-Highwood Index™

Highwood’s understanding of emissions in the natural gas industry has improved substantially beyond the methodology underlying the Greenhouse Gas Inventory. Private and public-led initiatives have launched aerial methane measurement technologies capable of gathering data at a rapid rate. In a recent preprint, Sherwin et al. summarized several years of data from aerial methane measurement technologies surveys (specifically Kairos Aerospace and Carbon Mapper) over one million sites. The aggregate measurements are approximately three orders of magnitude higher than previous synthesis work, making this the most comprehensive synthesis study to date.

In a subsequent white paper titled “The MiQ-Highwood Index™: A national-scale measurement-informed methane intensity for the United States”, Highwood and MiQ reviewed the methane emissions data synthesized in Sherwin et al. This analysis led to the creation of the first open-access measurement-informed methane intensity index for the U.S. natural gas sector. Methane intensity is defined here as methane emitted normalized to methane produced.

Extrapolating results from Sherwin et al. to the U.S. lower 48 onshore energy industry, Highwood and MiQ calculate a methane intensity of 1.0% for production operations and 2.2% for the full supply chain (values allocated to the natural gas product). However, the Sherwin et al. preprint is limited to the high-productivity Pennsylvania zone of the Appalachia basin. More data collection is required to accurately assess individual basin intensity variations. As new data becomes available, the index will be updated.

The MiQ-Highwood Index™ provides gas buyers the information to understand the environmental performance of their supply chain relative to the national average. improving the buyer’s confidence in accessing the certified gas market.

Energy Transition – Balancing Access Against Climate Objectives

Heather Isidoro

P.Eng., MBA, Senior Consultant,

Voluntary Initiatives, Highwood Emissions Management

As the world strives to achieve the climate goals set out in the 2015 Paris Agreement, parts of the world still do not have access to a single, basic, reliable energy source. As this, and other factors, continue to contribute to rising global energy demand, the energy industry has an important part to play. As the industry faces pressure to reduce GHG emissions, those who proactively exceed the regulatory requirements are starting to be rewarded. By participating in Voluntary Initiatives, energy companies are distinguishing themselves and leaders in clean-er energy, balancing both rising demand, and climate objectives.

Global Demand

Approximately 1 billion people still lack reliable access, or any access, to electricity. While environmental concerns are the driver behind energy transition, transition cannot be achieved at the expense of economic sustainability and development, or access to reliable energy. As the world population surpassed 8 billion in 2023, energy demand continues to increase, rather than decrease.

Canada Action notes the following anticipated demand increases:

- Natural gas demand is projected to grow by 1% annually from 2020-2035 (McKinsey)²

- Global oil demand is projected to grow to about 104 million barrels per day (bpd) by 2025 and up to 108 million bpd by 2030. (BMO Capital Markets)²

While the term energy transition is broadly thrown around, it is a common assumption that transition means moving completely away from fossil fuels to renewable sources of energy. However, this rising demand cannot be met without fossil fuels in the foreseeable future.

What is energy transition?

The concept of energy transition was first used by United States President Jimmy Carter in an address on the Nation of Energy regarding the 1970’s energy crisis:

“Look back into history to understand our energy problem. Twice in the last several hundred years, there has been a transition in the way people use energy… Because we are now running out of gas and oil, we must prepare quickly for a third change to strict conservation and to the renewed use of coal and to permanent renewable energy sources like solar power.”³

The World Economic Forum states, “energy transition is about more than decarbonization”⁴. While historical transitions were driven by availability of resources and cost, today’s transition is driven by environmental factors and the global effort to minimize climate change. However, the current transition is not simply about replacing fossil fuels.

Energy transition does not replace one source of energy with another. Throughout history, as new energy sources were discovered and commercialized, the transformation was gradual. Coal did not immediately replace wood but was incorporated alongside it until it became an economic and widespread source of energy. Similarly, energy did not replace coal, but was supplementary to coal, competing in cost and efficiency.

For this current transition to be successful the energy triangle needs to be balanced. Transition, or transformation, cannot be achieved at the expense of access or economic stability.

There is not one path to transition, but many paths that can be taken to develop cleaner sources of energy. While many immediately assume clean equates to renewables, increased efficiency and emissions mitigation of current energy sources is equally important. Generally considered a key contributor to climate change, the energy industry can also play a strategic part in transitioning the world to clean-er energy by participating in Voluntary Initiatives and exceeding regulatory minimums.

The Climate Impact of Energy

In an era of transition, where renewables also reached record high share of generation, 2021 and 2022 saw coal emissions grow year-over-year to record highs. As many countries undertake coal to gas initiatives, countries like China, India, Japan, Indonesia, and Vietnam continue annually to increase coal capacity. While developed countries push for clean energy, developing countries simply want access to energy. Fluctuating natural gas prices have even prompted some north American power producers to shift from natural gas back to coal to protect the bottom line.

In 2022 energy-related GHG emissions peaked at 41.3 Gt7 of CO2 equivalent, an increase of 6% from 2020-2021, and an additional 1% from 2021-2022⁵. The anthropogenic emissions (emitted by human activity) from carbon dioxide and methane account for approximately 89% and 10% of that total respectively⁵. Energy related carbon dioxide emissions are caused by fossil fuel usage, and the largest driver of growth was electricity demand. Energy related methane emissions are caused by venting, flaring, and leakage in the systems that produce and transport fossil fuels.

The Opportunity

While renewables continue to develop alongside fossil fuel, the energy industry has an opportunity to make a significant positive climate impact.

Diversifying and developing renewables are both capital intensive and require expertise and capabilities that are not always aligned with traditional energy expertise or operations. According to the International Energy Agency (IEA), less than 1% of total capital expenditures of the energy industry is invested in diversifying outside of core traditional operations.⁵

Energy demand is beyond the industry’s control and is driven by consumerism and a growing global population. Meeting that demand today requires fossil fuels, however, companies can undertake initiatives to lower the intensity of their operations. By reducing emissions from existing and new operations, energy companies can differentiate themselves to stakeholders who prioritize ESG performance alongside financial, and in some cases even profit from it.

“As of today, 15% of global energy related GHG emissions come from the process of getting energy out of the ground and to consumers. Reducing methane leaks to the atmosphere is the single most important and cost-effective way for the industry to bring down these emissions.”⁵

The IEA estimates that emissions could be reduced by almost 40% through methane reductions, reduced flaring and venting, and efficiency improvements by 2030⁶. Reducing emissions in this space requires more accurate quantification to accurately track reductions. By participating in Voluntary Initiatives, companies have access to the tools, support, frameworks, and markets to set and realize the benefits of targets that go beyond the minimum requirements. Energy producers can position themselves as leaders in energy transformation, setting standards to meet both rising future demands, alongside climate objectives.

- Did You Know? Global Oil & Gas Demand Continues to Grow! – Canada Action

- What is Energy Transition? (Definition, Benefits and Challenges) – TWI (twi-global.com)

- A beginner’s guide to the energy transition in five steps | World Economic Forum (weforum.org)

- The Oil and Gas Industry in Energy Transitions – Analysis – IEA

- Overview – Global Methane Tracker 2023 – Analysis – IEA

Report Sponsors

Key Findings

The following are insights derived from the information gathered, and on news and developments of each initiative.

The following 2022 insights remain true in 2023:

01. Initiatives continue to acknowledge their interoperability with each other by building up on existing methodologies and requirements instead of reinventing the wheel.

Establishing alignments and partnerships between initiatives provide participants the agility to achieve multiple programs using one set of data. For example, producers reporting to the US Environmental Protection Agency’s GHG Reporting Program will already have their emissions quantification using Subpart W guidelines. These producers are in a good position to access OGMP 2.0, the EPA Methane Challenge, Project Canary’s Low Methane Rating.

02. Measurement and reconciliation are now encouraged and/or required by many initiatives.

The availability of the Veritas protocols standardizes the measurement and reconciliation process, allowing certifications such as MiQ and the Low Methane Rating Protocol to point to Veritas for measurement and reconciliation methodologies.

03. Programs that require or encourage the use of direct measurements remain technology agnostic.

Participants know their emissions profile better and can make informed decisions to select the best available measurement technology that fits within their purposes and budget.

04. Publicly disclosing emissions data remains a prevalent practice among the initiatives.

Most initiatives share company-specific or anonymized emissions data with the public, including methane targets and aggregated source-level emissions. Initiatives that do not have specific rules on public disclosure have noted that the participating companies can still release the information at the companies’ discretion.

Key Changes and Highlights for 2023

01. Participation is growing in a few voluntary initiatives, while most have stalled.

In 2022, we saw certifications taking the lead in increased uptake. For 2023, we are seeing a shift of uptake leaders: OGMP 2.0 almost doubled their participants from last year’s count. MiQ and EO100 still have higher uptake than most initiatives.

However, the rate of uptake did not correlate with the required effort. Based on the data gathered, initiatives that rated themselves as moderate in the Effort scale had the highest increase in uptake in 2023. This indicates that companies are willing to concentrate their effort on initiatives that have established their interoperability and value add, be it in terms of financial, operational and/or reputational value. Once potential participants see these from an initiative, the required effort will likely cease to be a barrier.

| Initiative | Category | 2022 participants | 2023 participants | Effort |

|---|---|---|---|---|

| Oil and Gas Methane Partnership (OGMP) 2.0 | Commitment | 79 | 147 +86% | Moderate |

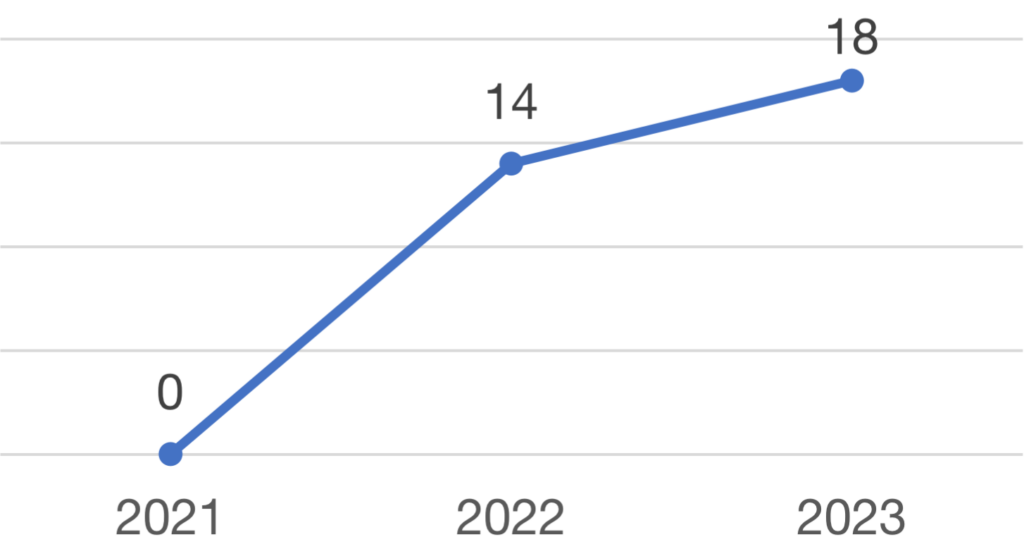

| The MiQ Standard | Certification | 14 | 18+29% | Moderate |

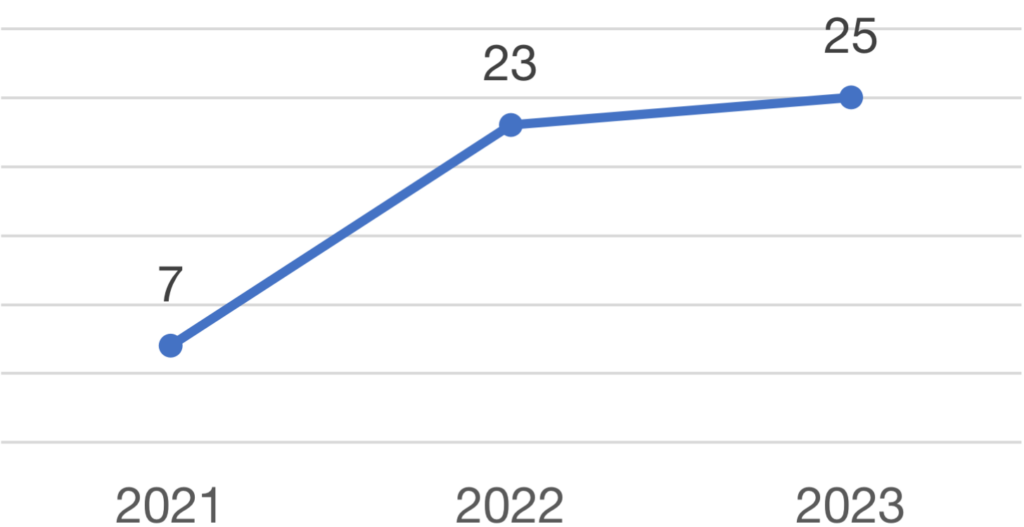

| EO100™ Standard for Responsible Energy Development | Certification | 23 | 25+9% | Moderate |

| The Environmental Partnership | Commitment | 97 | 102+5% | Low |

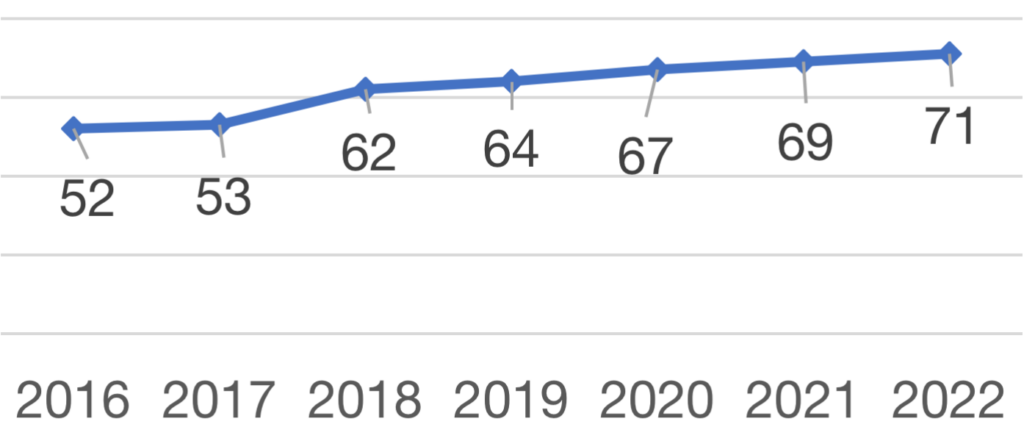

| EPA Methane Challenge | Commitment | 69 | 71+3% | Low |

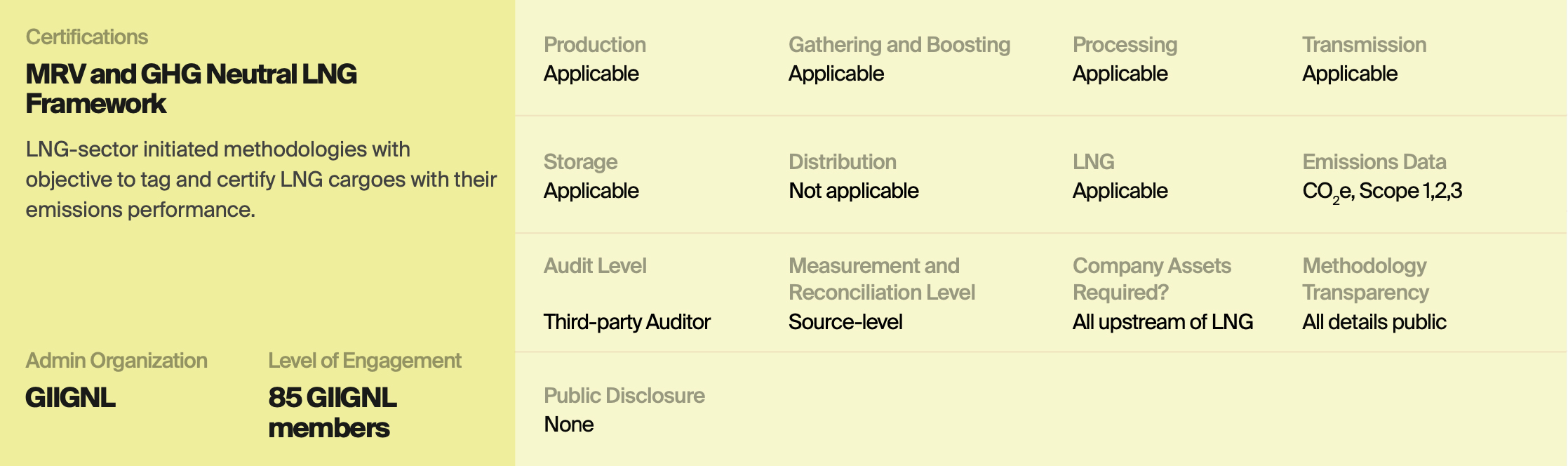

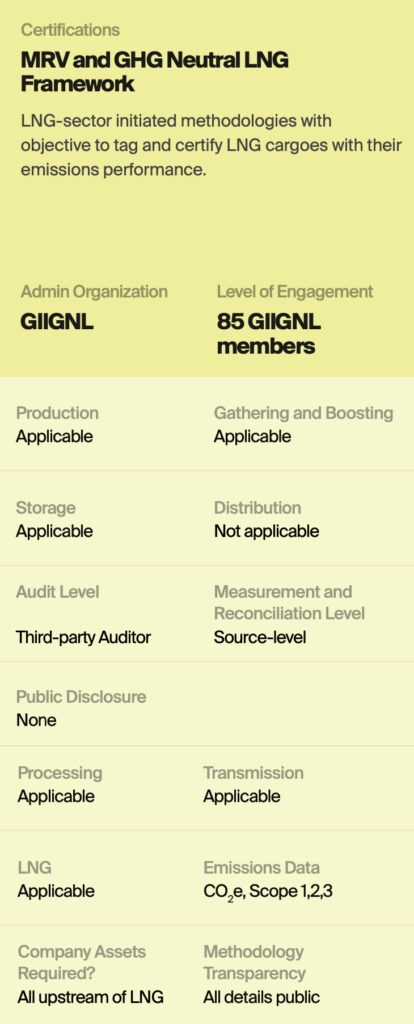

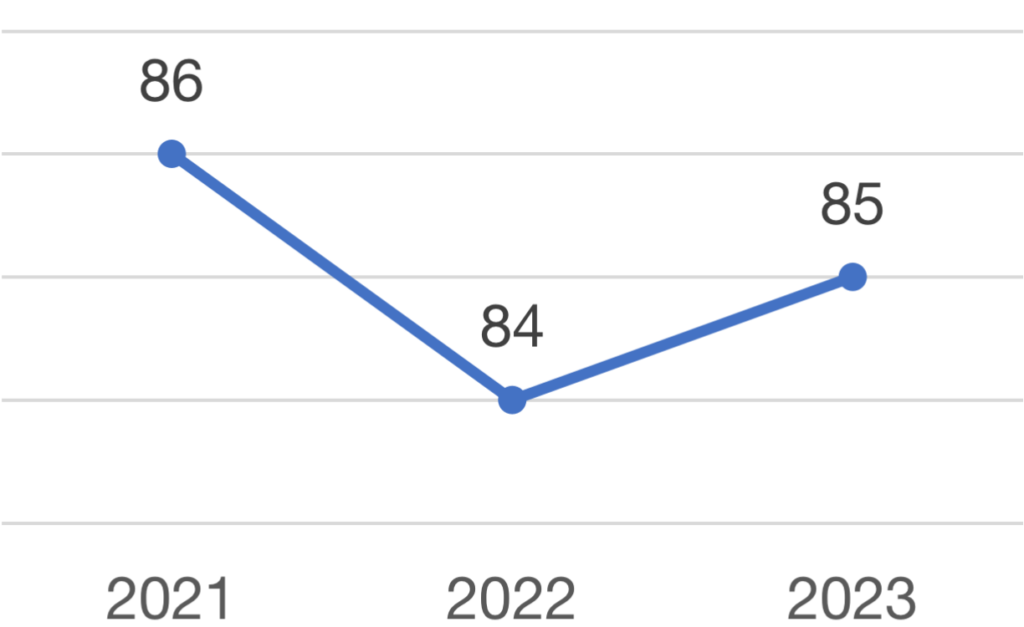

| MRV and GHG Neutral LNG Framework | Certification | 84 | 85+1% | Moderate |

02. Some regulatory bodies have started to structure disclosure requirements around voluntary initiatives to streamline and maximize interoperability.

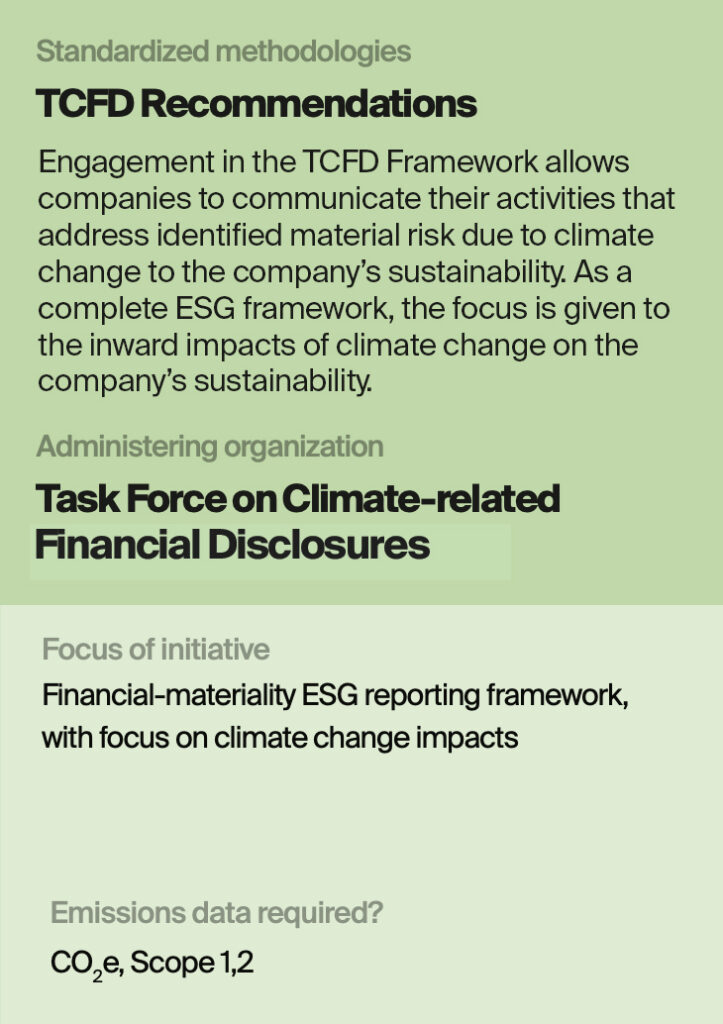

European Sustainability Reporting Standards are now aligned with International Sustainability Standards Board (ISSB) and Global Reporting Initiatives (GRI) disclosure standards, while Canadian Securities Administrator (CSA) has aligned CSA 51-107 with the Task Force on Climate-Related Financial Disclosures (TCFD) Recommendations.

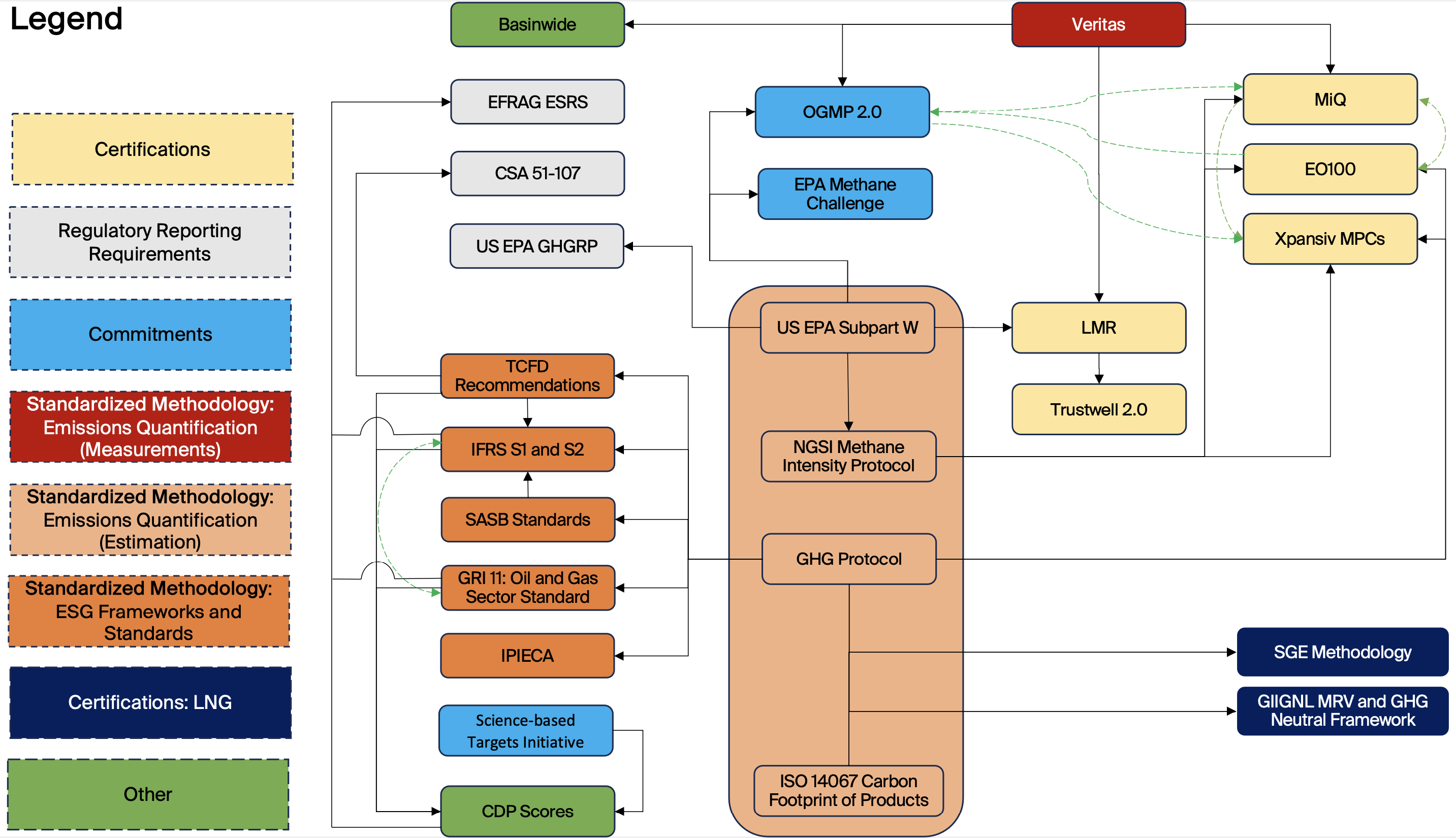

Linkages between initiatives and regulatory methodologies

This chart depicts the interrelations between different initiatives and existing regulatory mandates. Solid lines indicate the integration of standardized methodologies across voluntary initiatives and regulations, while dashed lines represent the interconnectedness of initiatives, showcasing their complementary and overlapping criteria.

03. Participating companies are facing heightened public scrutiny regarding their environmental claims.

This pressure drives administering organizations to develop their initiatives around transparency and verifiability, and for companies to be conscious about greenwashing and be aware of the reputation of the initiatives they participate in.

04. Initiatives are shifting towards increased verifiability and transparency.

All initiatives in the Certification category require either a third-party audit or an internal audit of the participants’ data. Most administering organizations also make their methodologies accessible to the public for full transparency.

05. Although the demand for certified gas is growing, it still has not reached a point where certified gas producers can command a premium over non-certified gas.

While we are seeing an increased interest in certified gas, the benefits to buyers of certified gas remains a gap that administering organizations need to establish and quantify. Additionally, companies looking to reduce their Scope 3 emissions tend to go for nature-based offset products instead of the low-methane products. These offset products tend to be abundant in supply across multiple project types and are easier to access through multiple registries, such as the Verra Registry and the Impact Registry.

06. Uptake in LNG certification initiatives is slow in gaining traction.

Only six LNG cargoes are known to have received emissions statements since the inception of LNG-specific certification programs.

07. Several initiatives have developed indices for establishing benchmark methane performances.

Xpansiv launched the Digital Fuels Program 2023 Methane Emissions Benchmark, MiQ published the MiQ-Highwood Index, and the Basinwide Alliance has publicized plans to establish the Basinwide Methane Emissions Index.

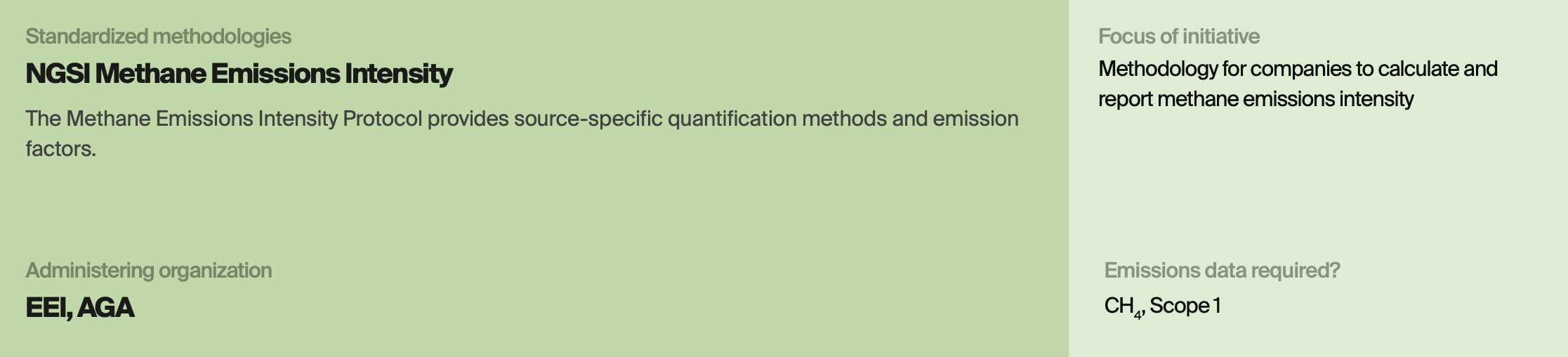

Understanding these intricate relationships empowers participants to become agile in efficiently navigating through multiple initiatives and regulatory requirements. For example, a company working to meet requirements using NGSI Methane Intensity Protocol for EO100 certification can simultaneously fulfill prerequisites for other initiatives that use NGSI, such as Xpansiv MPCs.

Likewise, participants in OGMP 2.0 can obtain MiQ certification by employing identical methodologies to quantify emissions. Companies with certified methane emissions under MiQ standards can further attain full ESG verification through EO100.

Knowledge Gaps

We are seeing some gaps from the 2022 Report being addressed by one or more organizations, while others have not yet been addressed.

| Gaps in 2022 | Progress in the past year |

|---|---|

| How can consolidation and harmonization of initiatives improve? | Multiple organizations, including regulatory agencies, have expressed their existing interoperability with other organizations. (See Key Findings section) |

| How can emissions measurement technologies be used to collect meaningful data? | Carbon Mapper, a non-profit organization, has made publicly available their top-down methane and carbon dioxide emissions measurement data. |

| How should reconciliation of measurements and bottom-up inventories be performed? | GTI Energy’s Veritas initiative has stepped up to provide guidance on conducting measurements and performing reconciliation. |

| Is there a meta-initiative that can collect, aggregate, and disseminate reported data?

How can more robust and transparent differentiated gas markets be established? |

No significant progress was noted over the previous year |

Gaps for 2023

01. Harmonization between regulations and voluntary initiatives.

Will initiatives adopt regulatory disclosure requirements, or the other way around? The alignment in their requirements will decrease the barriers in adoption of voluntary initiatives.

02. Source of truth for the benefits of voluntary initiatives – chicken and egg conundrum.

A major barrier in the adoption of certification and commitment initiatives has been the uncertainty around the benefits versus costs. However, a wide adoption of the initiative must happen to decrease this uncertainty.

03. The shift towards increased transparency and public disclosure can expose participants to greater public scrutiny.

Potentially discouraging companies from joining an initiative. How can we maintain our efforts to encourage transparency and accountability without dissuading companies from engaging in the programs?

04. Observing trends in top-down measurements often takes years, which can deter potential participants who desire immediate results from engaging in initiatives that promote measurement reconciliation.

Encouraging companies to delve deeper into understanding their complete emissions profile through direct measurement remains to be a significant challenge.

05. There is no centralized and publicly accessible database that collects, aggregates, and analyzes all information from the different initiatives.

Gaining insights from the information amassed by these initiatives holds significant potential for regulators, educators, and other stakeholders involved in shaping a global strategy for mitigating methane and other GHG emissions.

Moving Forward - Call to Action

01. Administering organizations must capitalize on their successes by quantifying the benefits of participation, not only to increase buy-in, but also to identify opportunities for alignment with similar initiatives.

02. All stakeholders should continue to collaborate, establish alignments, and work towards consolidation of complementary programs to provide companies with the agility to participate in multiple initiatives using the same set of data.

03. Administering organizations should continue promoting transparency and move towards requiring independent verification to increase the credibility of their programs, shield participants from possible allegations of greenwashing, and enhance stakeholder confidence

04. The energy industry should lead by example and promote better emissions quantification, reporting, and mitigation to encourage other industries to follow suit.

Summary of Results

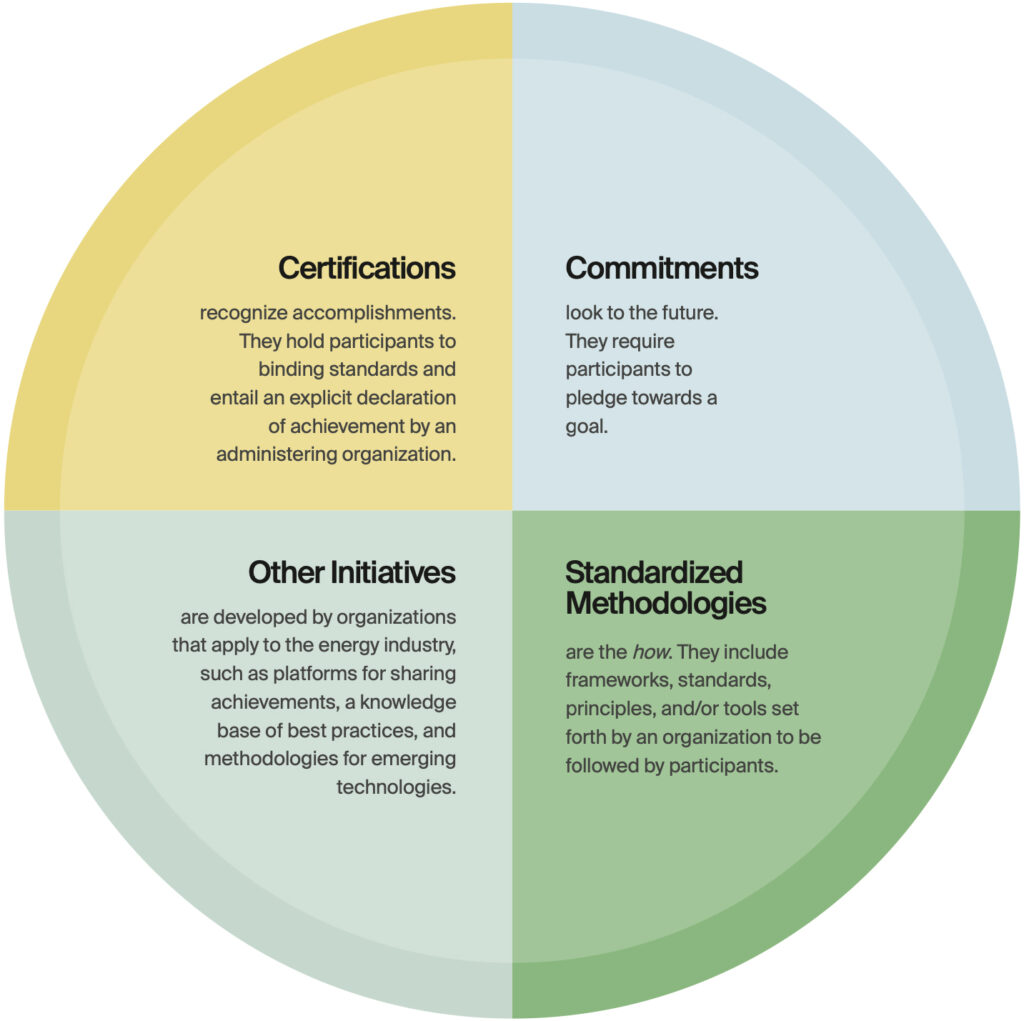

The 2023 edition of the Highwood Voluntary Initiatives Report includes 24 voluntary initiatives grouped into these four categories:

Additional information on each initiative can be found in the appendices.

Additional information on each initiative can be found in the appendices.

Additional information on each initiative can be found in the appendices.

The following pages present the tabulated results of this study, based on the administrating organizations' responses and on publicly available data put together by Highwood’s research team. The results were summarized based on the following key points of interest:

- Level of engagement (if applicable)

- Sector applicability

- Emissions quantification/reporting coverage

- Audit requirement

- Measurement and reconciliation requirement

- Company asset coverage

- Disclosure and transparency

It is important to note that Highwood does not consider any one initiative to be “better” or “worse” than any other based on the applicability of the categories. Each type of initiative has a unique approach to engaging with industry and recognizing the efforts made by the participants. Highly rigorous initiatives set high standards, but they also present financial and logistical barriers for companies who are not ready for that level of commitment. Initiatives with less stringent requirements enable broader participant and provide an important gateway towards greater action.

Certifications

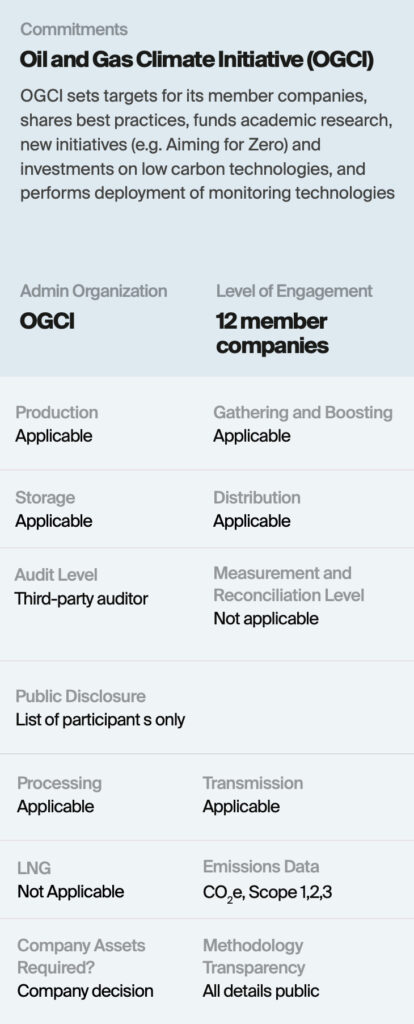

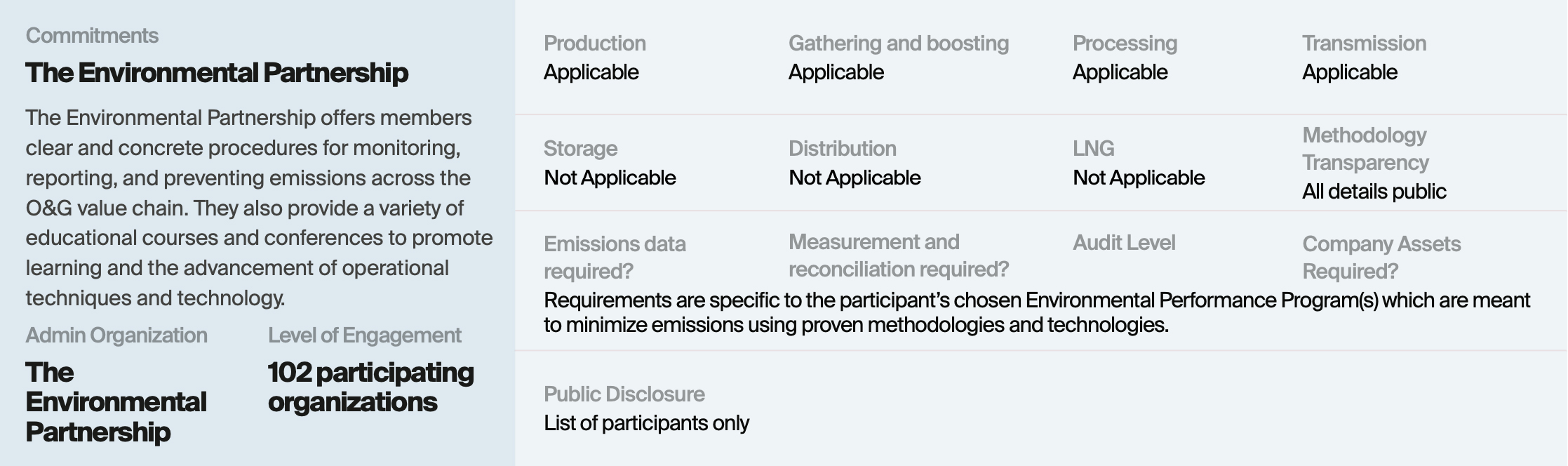

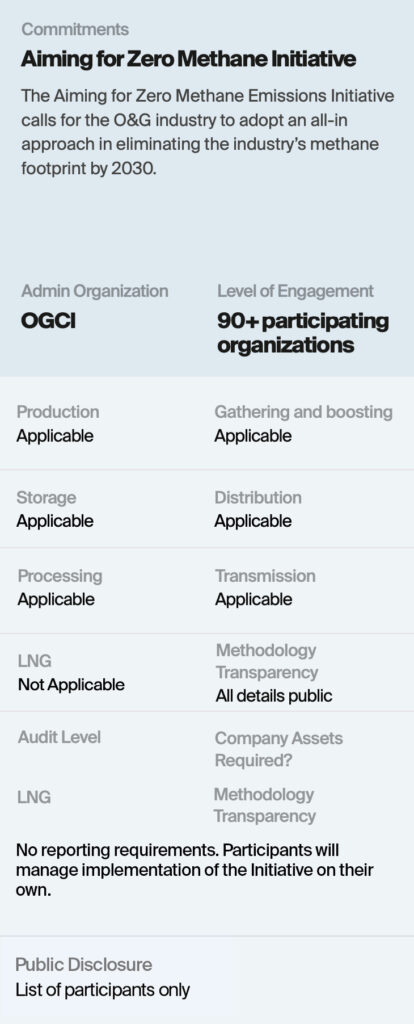

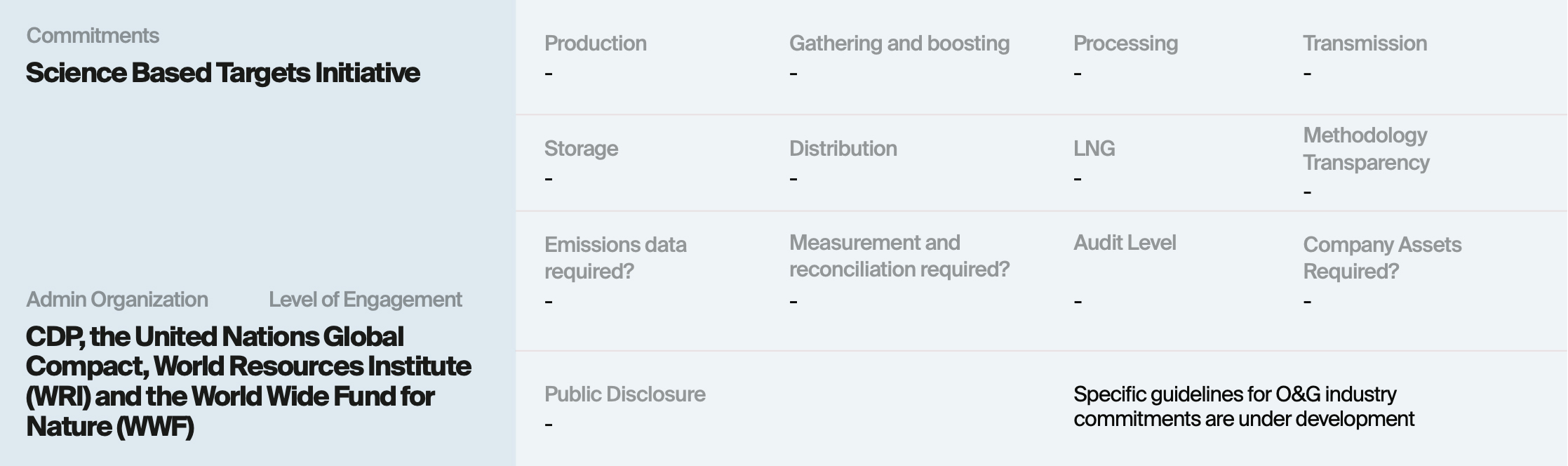

Commitments

Standardized Methodologies

Other

* Information is limited to publicly available data and to data provided by the administering organizations to Highwood.

Resources & Links

Highwood Resources

- The MiQ-Highwood Index

- Highwood Emissions Management Voluntary Initiatives 2021

- Highwood Emissions Management Voluntary Initiatives 2022

Software

Methane Measurement Technologies

Regulatory & Standards Resources

- ISO 14067:2018 – Greenhouse gases — Carbon footprint of products — Requirements and guidelines for quantification

- United States Environmental Protection Agency Subpart W – Petroleum and Natural Gas Systems

- 51-107 – Consultation Climate-related Disclosure

- European Financial Reporting Advisory Group – European Sustainability Reporting Standards

- United States Environmental Protection Agency Greenhouse Gas Reporting Program (GHGRP)

Certification Program

- The MiQ Standard – Methane Intelligence

- EO100™ Standard for Responsible Energy Development, Equitable Origin

- Digital Natural Gas and Methane Performance Certificates, Xpansiv

- TrustWell Environmental Assessment 2.0, Project Canary

- Low Methane Rating Protocol, Project Canary

- SGE Methodology, Chevron, Qatar Energy, Pavillion Energy

- MRV and GHG Neutral LNG Framework, GIIGNL

Commitment Program

- OGMP 2.0 – Oil and Gas Methane Partnership 2.0

- ONE Future Emissions Intensity Commitment, United States Environmental Protection Agency

- Oil and Gas Climate Initiative (OGCI)

- EPA Methane Challenge, United States Environmental Protection Agency

- The Environmental Partnership

- Aiming for Zero Methane Emissions Initiative, Oil and Gas Climate Initiative

- Science Based Targets Initiative (SBTi), CDP, the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF)

Standardized Methodology

- Veritas, GTI Energy

- NGSI Methane Emissions Intensity Protocol, EEI, AGA

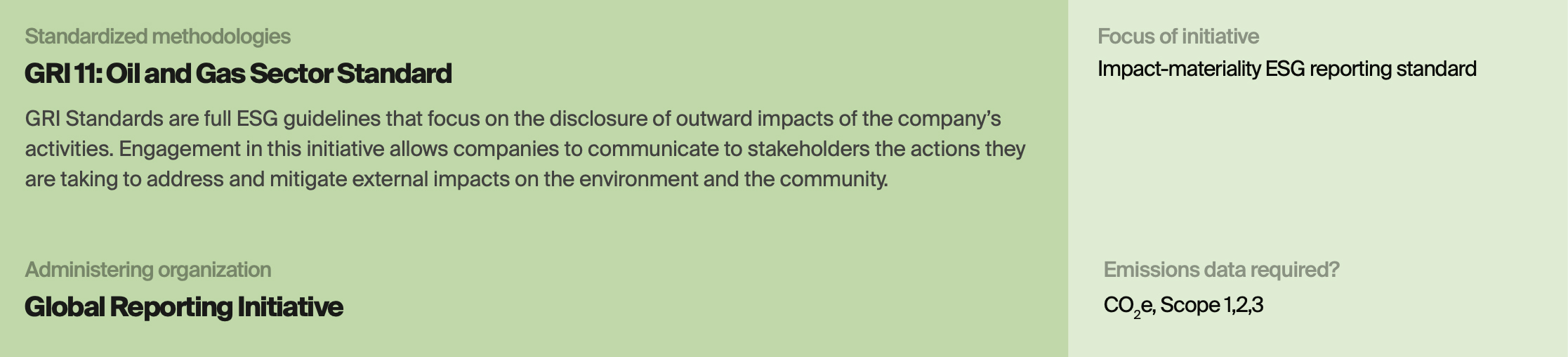

- GRI 11: Oil and Gas Sector Standards, Global Reporting Initiative

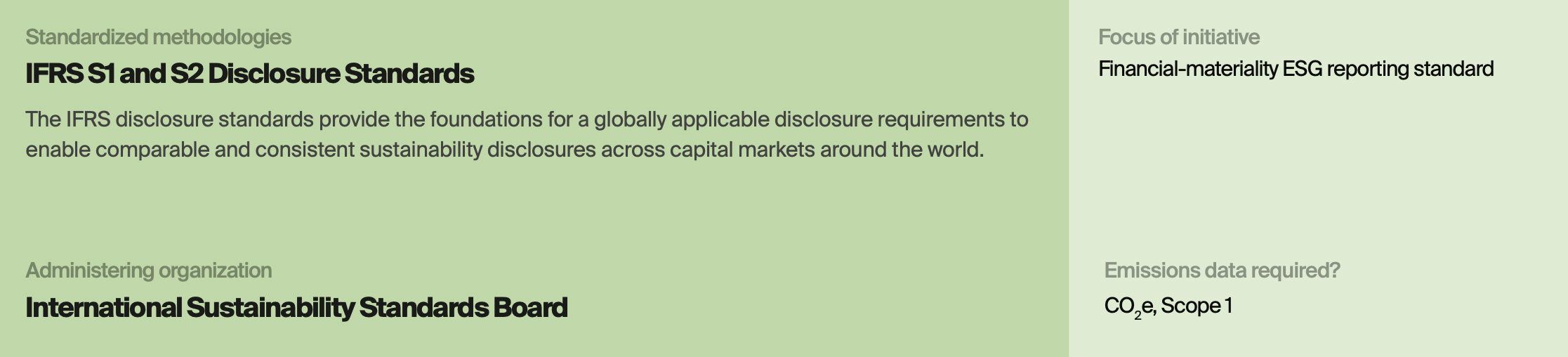

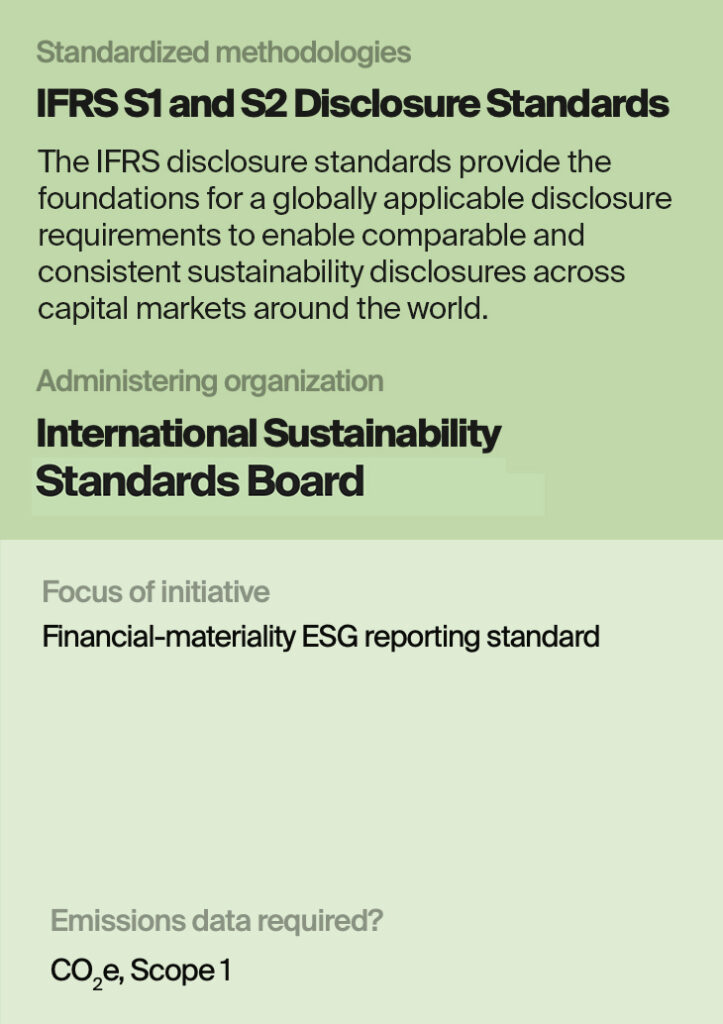

- IFRS S1 and IFRS S2

- Taskforce on Climate-Related Financial Disclosure Recommendations

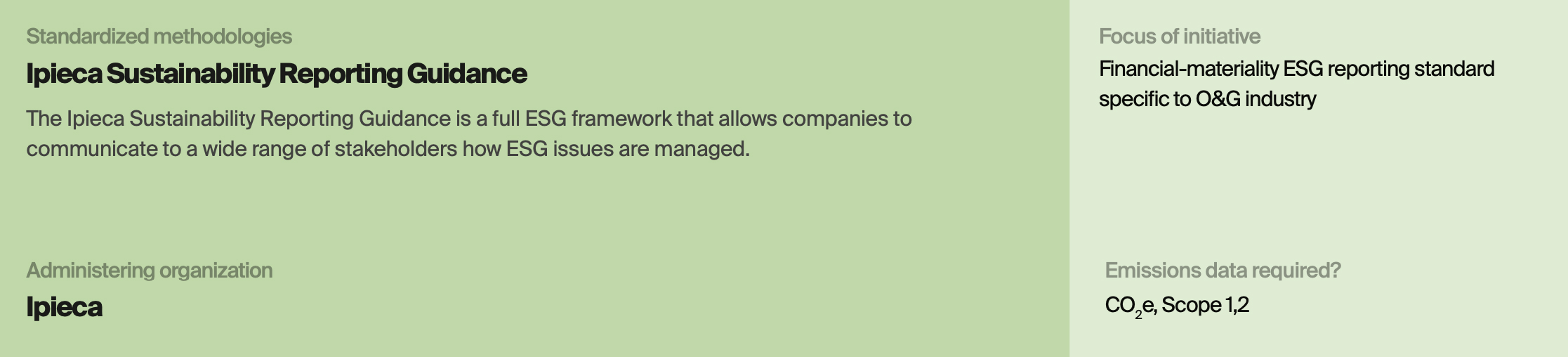

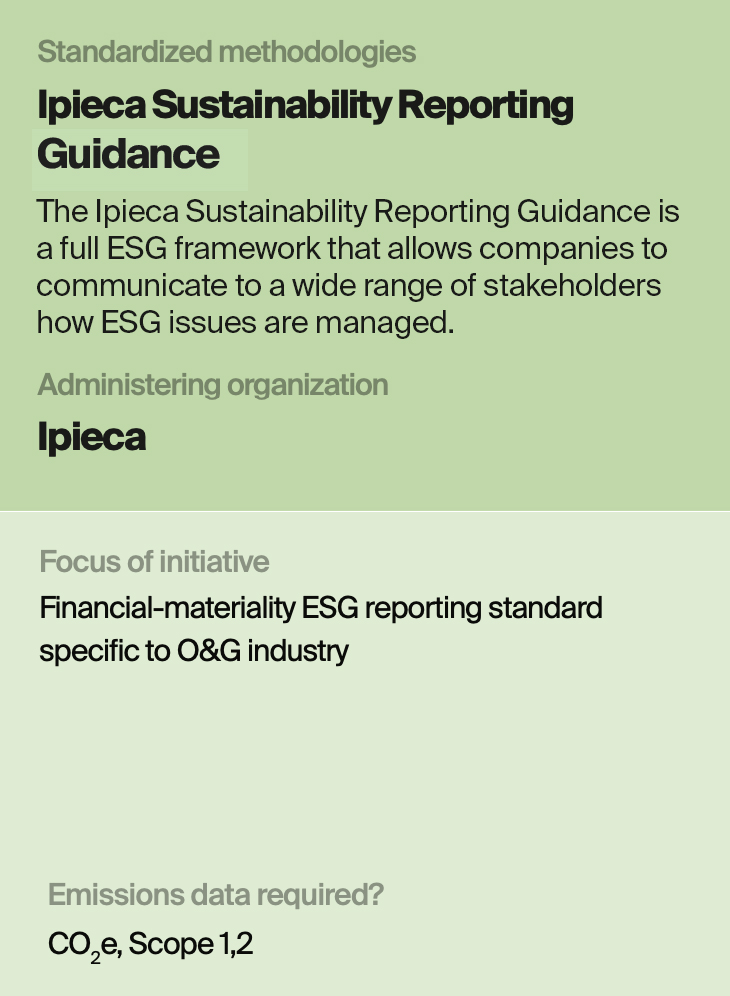

- Ipieca Sustainability Reporting Guidance

Other

Note: These links have been provided to help guide you through methane requirements, resources, and initiatives. All links are current to our knowledge as at the time of publishing this report. We cannot guarantee that links are accurate or up to date.

Appendix A - Initiatives

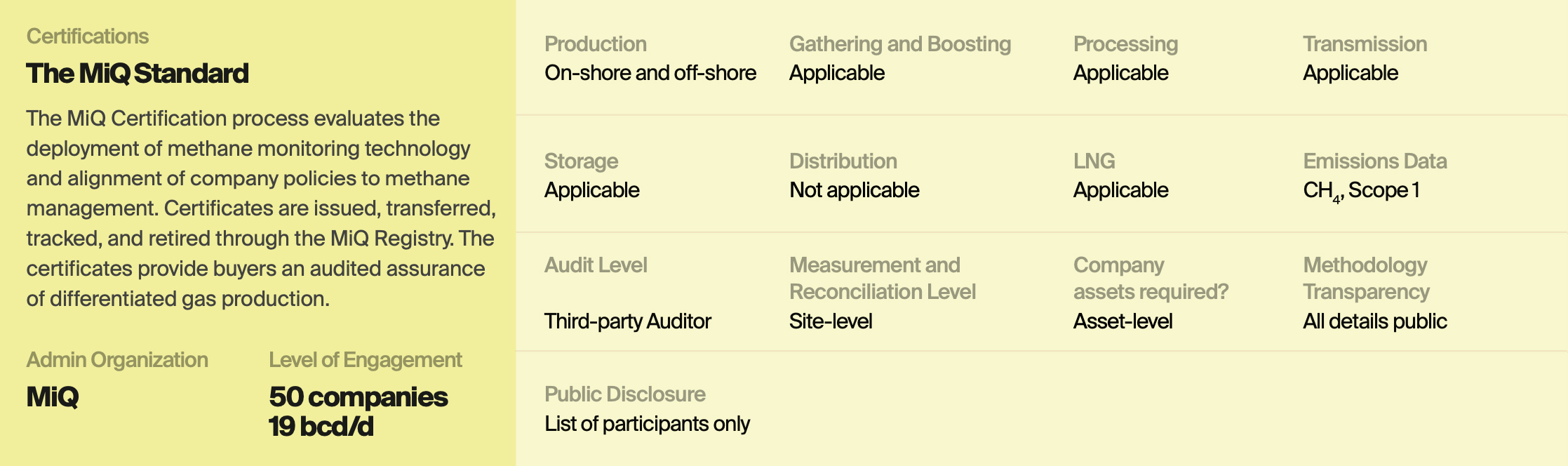

The MiQ Standard

Certification

Key takeaways

The MiQ Standard is an independently audited certification initiative that promotes holistic evaluation by requiring operators to disclose their methane emissions intensity, deploy advanced methane monitoring technology, include all detected events into their emissions inventory, and implement emission control best practices.

Companies certified in MiQ enjoy the benefits of having differentiated gas. Operators use the MiQ Registry, MiQ’s certificates-tracking hub, to attract buyers who are looking for accountable and verifiable energy for their own emissions management initiatives. The MiQ Registry provides the platform for tracking certificates from inception to retirement/end-of-use – as the physical gas moves, so do the certificates.

What’s new in 2023?

01. Updated Onshore Production and Offshore Production standard for Methane Emissions Performance

02. Released Gathering & Boosting, Processing, Transmission & Storage, and LNG standard for Methane Emissions Performance

03. Released Greenhouse Gas Intensity Standard for all segments

04. Released MiQ-Highwood Index

Number of MiQ-certified facilities

Quick Facts

Emission scopes coverage

Scope 1 for Methane Intensity, Scope 1 and 2 for GHG Intensity, and certificates can be transacted for Scope 3 attestations

Status of the program

Fully implemented

Initiative year of inception

2020

Funding structure of administering organization

Privately funded non-profit

Geographic coverage

Global

Relative cost and level of effort required

Moderate

Supply chain coverage

All oil and gas industry segments, including LNG liquefaction, shipping and regasification

Transparency

All initiative requirements and methodologies are fully transparent and publicly available. All calculations, methodologies, and scoring criteria are clearly defined.

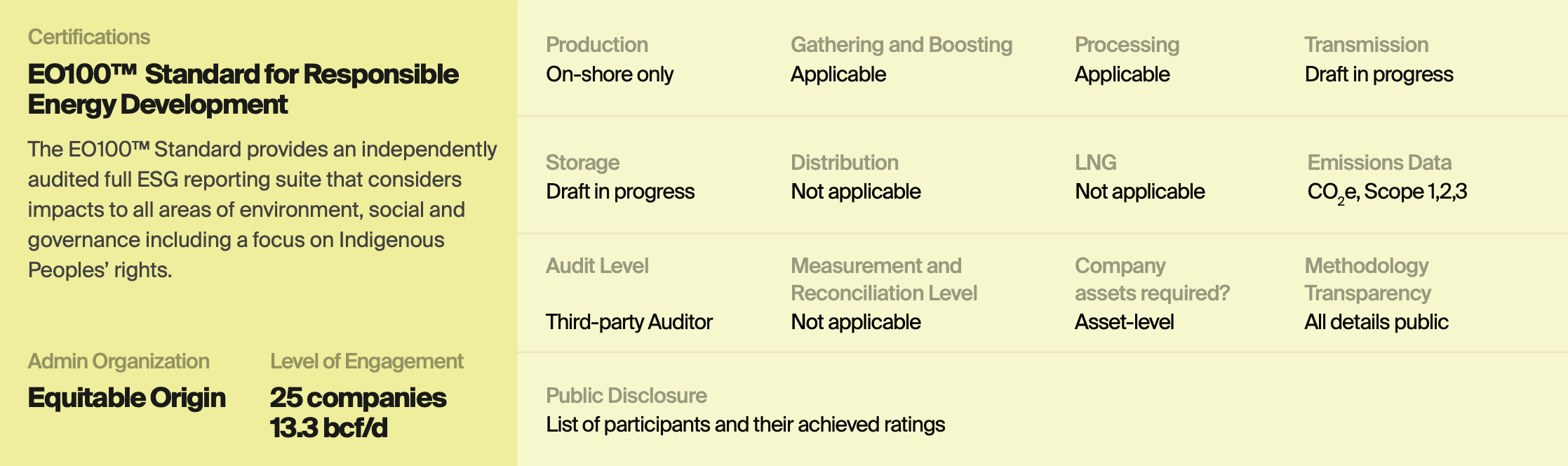

EO100™ Standard for Responsible Energy Development

Certification

Key takeaways

EO100™ is technology neutral with publicly available methodologies and resources, and it is audited by third-party organizations. Certifications are issued on an asset-level, and there is no allowance for partial certifications within a given boundary or basin.

In 2021, EO and MiQ started working together to issue joint certifications. This partnership is expected to yield additional uptake of participants in the coming years.

What’s new in 2023?

EO100™ has shifted from a pass/fail rating system to letter grade scoring in 2023. By switching to letter-based grading, EO100™ aims to incentivize producers to improve over time. The new grading system requires a minimum score of 70% under each of the standard’s five principles to get certified.

Number of EO100-certified assets

Quick Facts

Website

www.energystandards.org

Emission scopes coverage

Scope 1, 2 and 3

Name of administering organization(s)

Equitable Origin

Status of the program

Fully implemented

Initiative year of inception

2009

Funding structure of administering organization

Privately funded non-profit

Geographic coverage

Global

Relative cost and level of effort required

Low cost, moderate effort

Transparency

All initiative requirements and methodologies are fully transparent and publicly available. All calculations, methodologies, and scoring criteria are clearly defined.

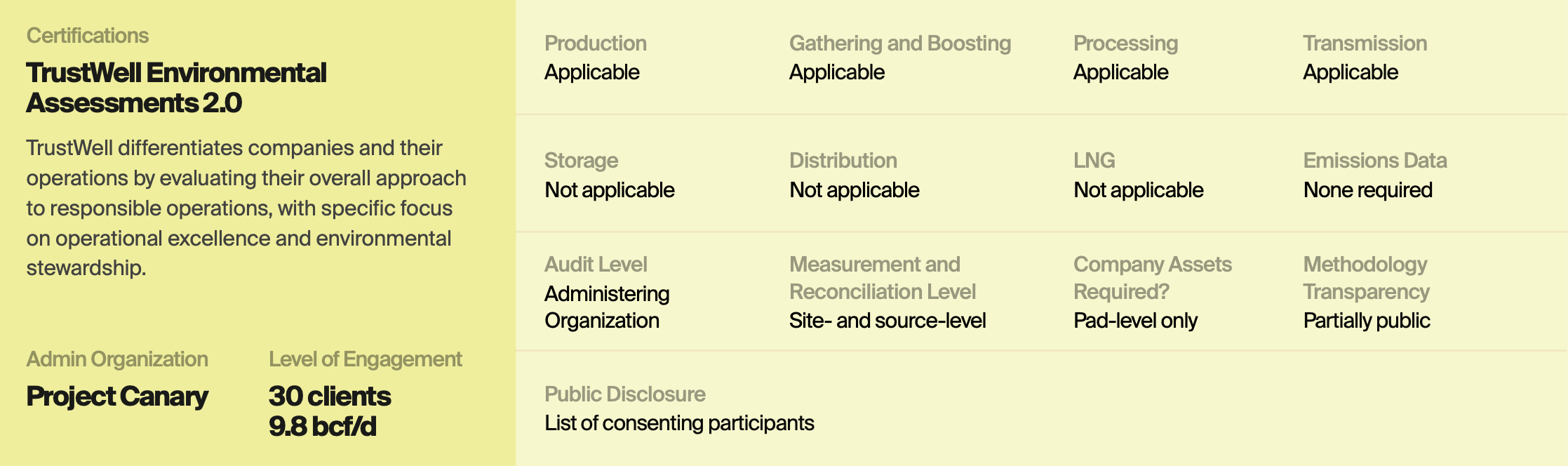

TrustWell Environmental Assessments 2.0

Certification

Key takeaways

Project Canary’s TrustWell Environmental Assessment differentiates companies and their operations by evaluating their overall approach to responsible operations, specifically regarding operational excellence and environmental stewardship. TrustWell provides a cost-effective environmental assessment based on engineering risk and environmental mitigation.

A performance score is provided for each individual asset undergoing the assessment. Embedded in these scores are a producer’s operational insights, benchmarking data, and tradable, registry-ready environmental attributes.

Operators can then place these performance ratings on a digital registry, such as Xpansiv’s CBL. Additionally, operators can use their assessment to prioritize operational changes within their assets to improve efficiencies and overall environmental performance.

Project Canary maintains an ongoing relationship with all participants of the TrustWell program. This level of engagement provides operators with a path toward continuous improvement across all environmental attributes.

Quick Facts

Emission scopes coverage

N/A

Name of administering organization(s)

Project Canary

Status of the program

Fully implemented

Initiative year of inception

2022

Funding structure of administering organization

Privately funded for-profit

Geographic coverage

Global

Relative cost and level of effort required

Low cost, moderate effort

Emissions/ESG coverage

Environmental and social considerations

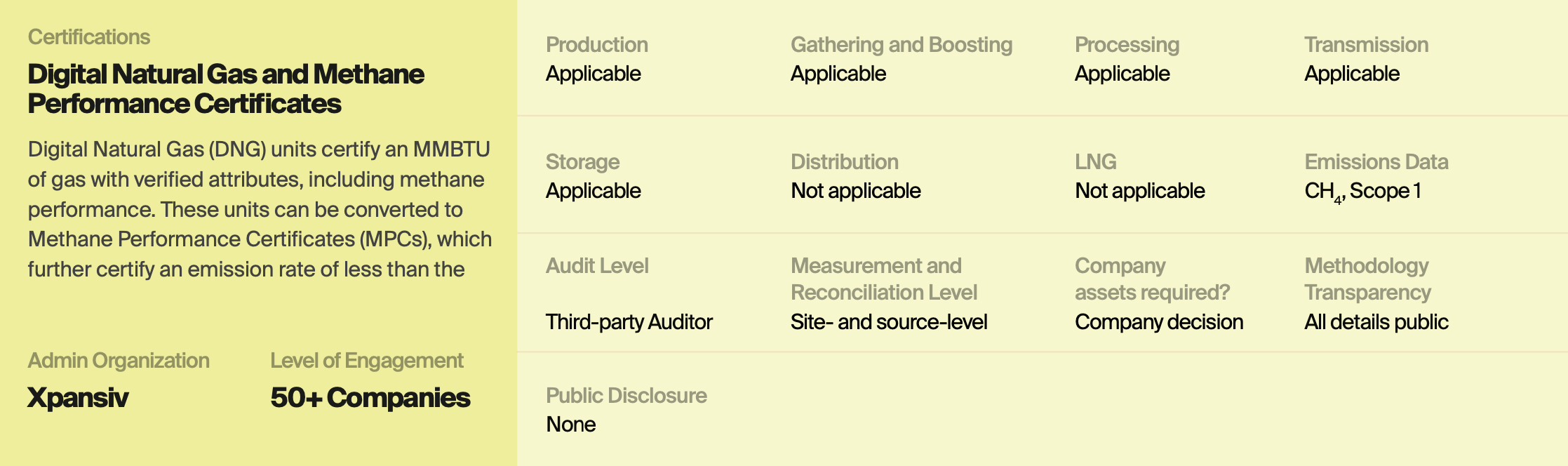

Digital Natural Gas and Methane Performance Certificates

Certification

Key takeaways

DNGs and MPCs are two of many certification programs in Xpansiv’s Digital Fuels Program. The environmental performance metrics encrypted into DNG are derived directly from empirical production and environmental monitoring data. Producers that register DNGs and MPCs have an immutable record of the environmental data of specific units of gas, including their methane performance.

The Digital Fuels Program, which the DNG and MPC products are part of, aspires to drive the transition to low carbon energy with a new class of standardized environmental attributes that differentiate fuels based on ESG performance.

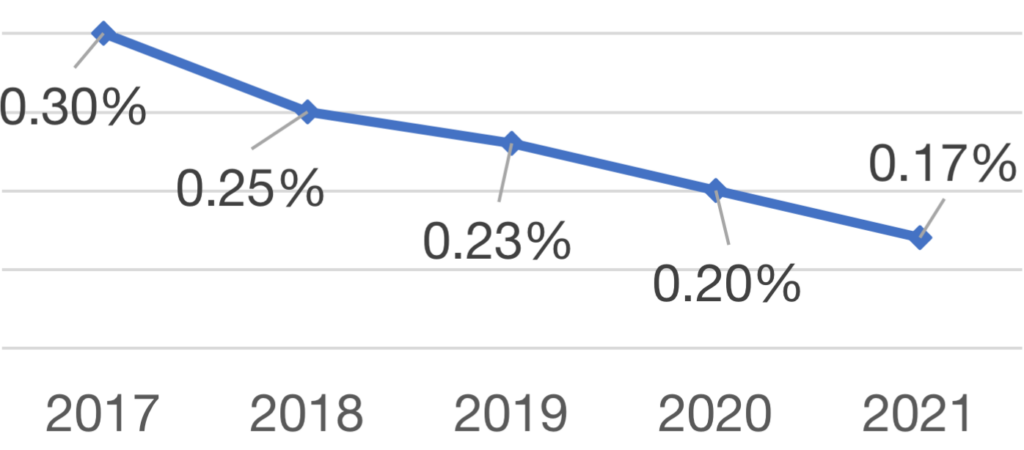

Digital Natural Gas units having methane emissions intensity lower than 0.1% qualify for conversion to MPCs.

What’s new in 2023?

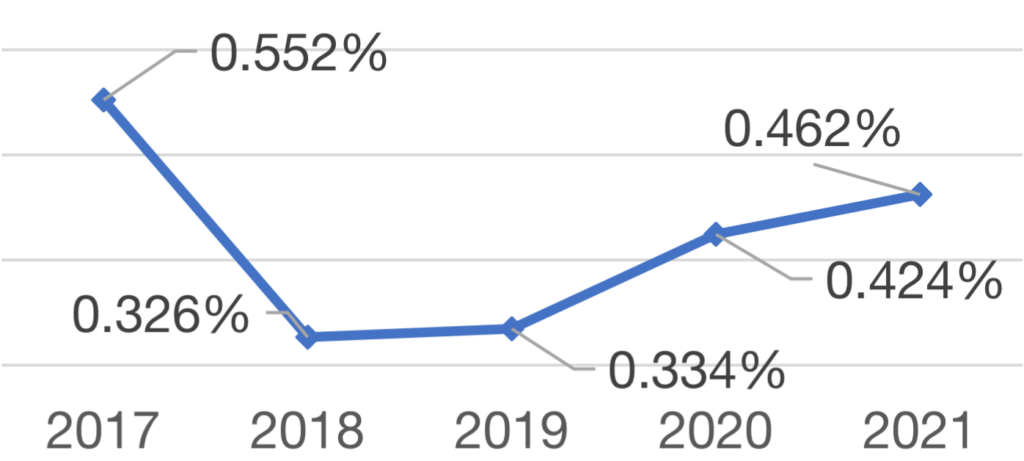

The Digital Fuels Program updates their baseline rate of methane emissions according to the latest US Greenhouse Gas Emissions Inventory. For 2021 it was 0.437% and was updated to 0.428% last June 2022.

Xpansiv published in July 2023 its guidance on MPC generation for the Processing, Transmission, and Storage segments. The guidance provides intensity thresholds that operators will have to achieve to generate MPCs.

About Xpansiv

Xpansiv is a global exchange for ESG commodities, allowing producers and customers to track, measure, and transact commodities based on environmental and other derived attributes. The goal is to enable major commodity groups to operate in a single marketplace so that participants can have a transparent, auditable dataset for registering and claiming ESG attributes tied to specific production units.

Quick Facts

Emission scopes coverage

Scope 1, 2 and 3

Name of administering organization(s)

Xpansiv

Status of the program

Fully implemented

Initiative year of inception

2021

Funding structure of administering organization

Privately funded for-profit

Geographic coverage

Global

Relative cost and level of effort required

Low cost, moderate effort

Transparency

All initiative requirements and methodologies are fully transparent and publicly available. All calculations, methodologies, and scoring criteria are clearly defined.

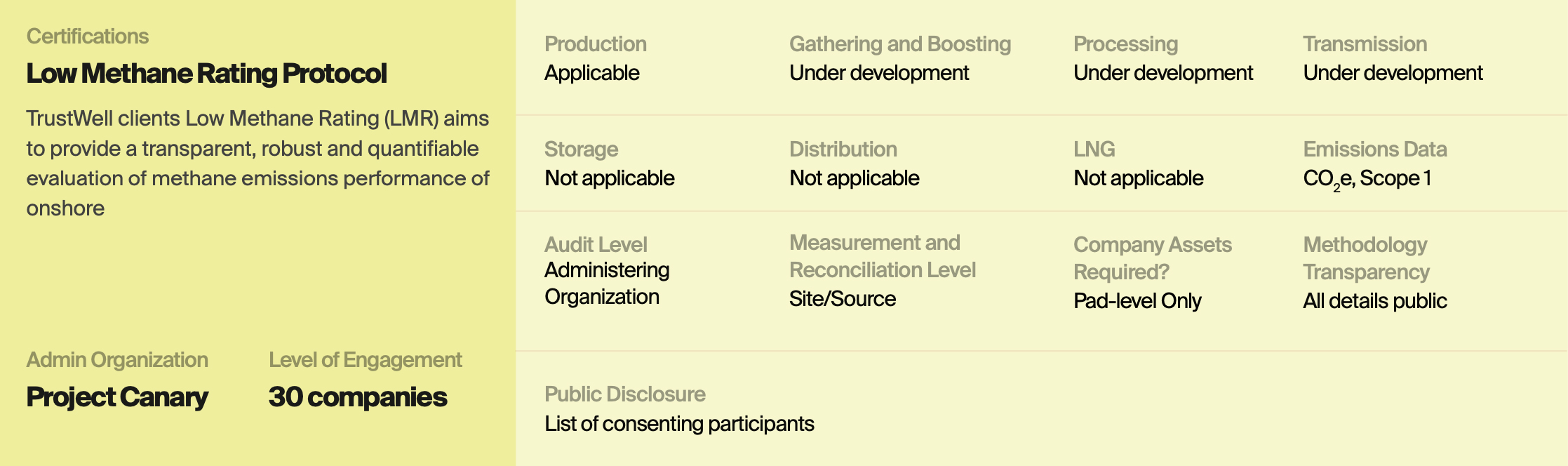

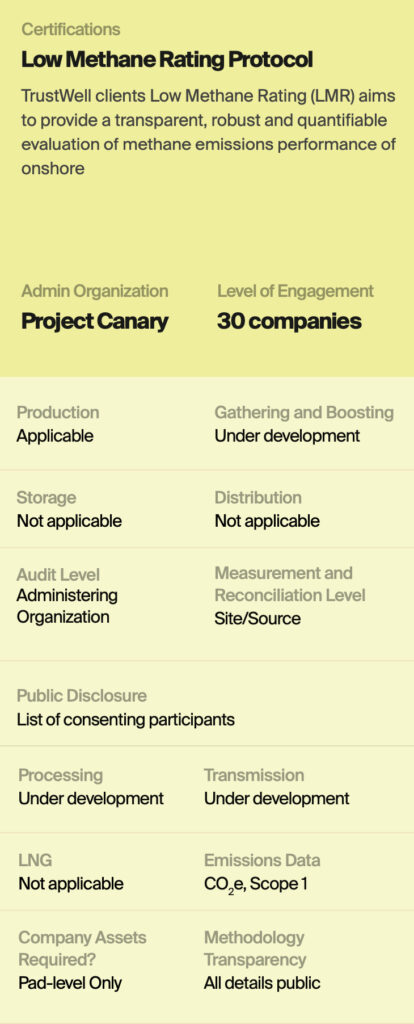

Low Methane Rating Protocol

Certification

Key takeaways

The Low Methane Rating Protocol emphasizes both basin and pad-level methane intensities, eliminating selection bias and providing the most granular level of emissions performance available. The protocol provides differentiation and visibility to operators that are utilizing best industry practices and advanced methane measurement and monitoring technologies.

The comprehensive process provides operators with technology-enhanced registry-ready data that is completely registry agnostic and free of any conflict of interest.

What’s ahead?

A Low Carbon Rating (LCR) for the midstream sector is currently under development and will be released in 3Q 2023. The LCR will cover the midstream gathering and boosting, processing, and transmission segments.

Project Canary intends LMR to be an evolving and iterative program that adjusts to changes in regulations, industry best practices, and technology landscapes. Multiple stakeholders such as technology providers and consultants will be involved in the program’s continuous improvement.

Quick Facts

Emission scopes coverage

Scope 1 (Scope 2 and 3 can be included to achieve better ratings)

Name of administering organization(s)

Project Canary

Status of the program

Fully implemented

Initiative year of inception

2023

Funding structure of administering organization

Privately funded for-profit

Geographic coverage

Global

Relative cost and level of effort required

Moderate

Supply chain coverage

Production

Transparency

All initiative requirements and methodologies are fully transparent and publicly available. All calculations, methodologies, and scoring criteria are clearly defined.

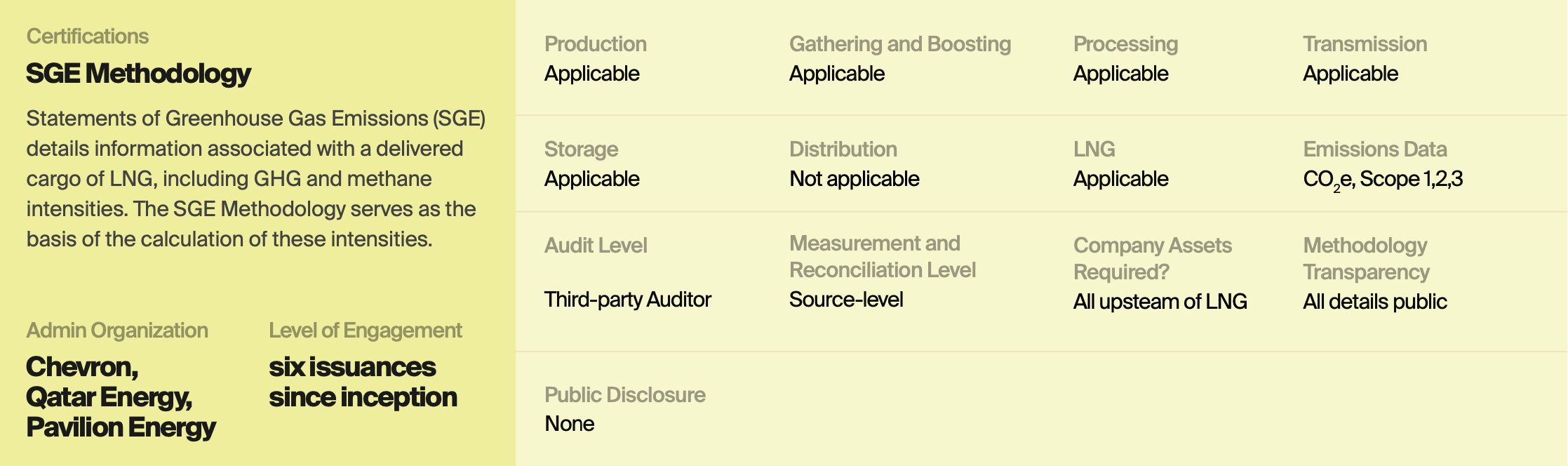

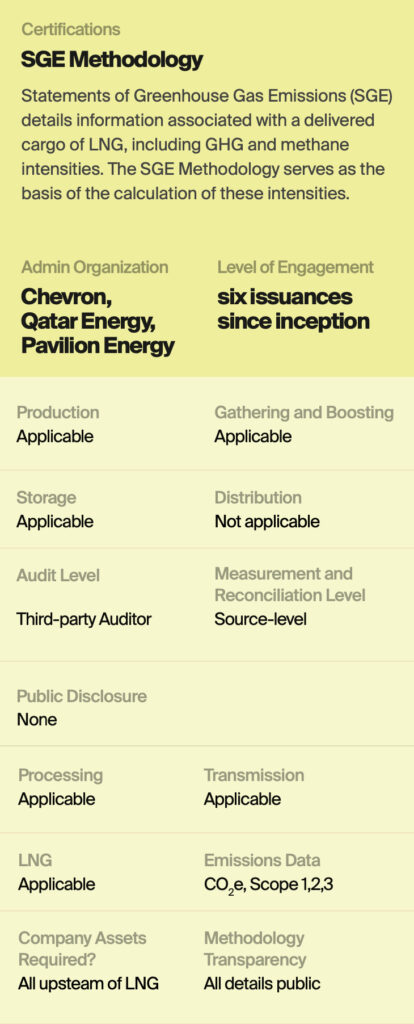

SGE Methodology

Certification - LNG

Key takeaways

The SGE Methodology establishes a strong foundation for improved emissions accountability throughout the LNG value chain. The emissions associated with a cargo of LNG are quantified, evaluated, and then provided with a Statement of Greenhouse Gas Emissions (SGE) to certify the cargo’s emissions intensity.

The SGE Methodology requires quantification of Scope 1, 2, and 3. Scope 3 emissions quantification is approached based on product life cycle accounting methods from production at the wellhead to delivery at the discharge manifold.

These SGE reports must be done per cargo and require third-party verification to address reasonable assurance expectations.

Similarities with GIIGNL

Unlike SGE Methodology’s similar LNG-sector initiative by GIIGNL, the SGE Methodology explicitly disallows the use of offsets in its cargo tags. Both frameworks, however, agree to the inclusion of the accounting of emissions from carbon capture, utilization, and storage.

The SGE methodology and GIIGNL’s framework establish a strong foundation for improved emissions accountability throughout the LNG value chain, paving the path for additional decarbonization measures toward a lower carbon future from wellhead to burner-tip.

Quick Facts

Emission scopes coverage

Scope 1, 2 and 3

Name of administering organization(s)

Chevron, QatarEnergy, Pavilion Energy

Status of the program

Fully implemented

Initiative year of inception

2021

Funding structure of administering organization

Privately funded for-profit

Geographic coverage

Global

Relative cost and level of effort required

Moderate

Transparency

All initiative requirements and methodologies are fully transparent and publicly available. All calculations, methodologies, and scoring criteria are clearly defined.

MRV and GHG Neutral LNG Framework

Certification - LNG

Key takeaways

GIIGNL has developed guidelines to quantify the GHG emissions associated with an LNG cargo. These guidelines can be applied either for a specific stage, a partial life cycle, or the entire value chain, including the end-use of the LNG. GIIGNL aims to increase the transparency of emissions accounting in this industry segment by making the Framework accessible to all participants.

On carbon capture and offsets

For the net overall emissions intensity calculations, the MRV and GHG Neutral LNG Framework allows the accounting of emissions from carbon capture, utilization, and storage. For cargoes using offsets in their quantification for emissions intensity, an “offset-included” cargo statement will be issued instead.”

Aiming to capture the emissions profile of the entire value chain, the framework issues Stage Statements and Cargo Statements. Stage Statements are verified statements of emissions intensity issued to segment participants along the value chain of the specific LNG cargo.

Cargo Statements are verified value-chain GHG profiles of the specific LNG cargo that provide additional information, like whether offsets were used, if there is a robust emission reductions plan, or if the cargo conforms to the carbon neutrality standard specified in the framework.

GIIGNL Membership

Quick Facts

Emission scopes coverage

Scope 1, 2 and 3

Status of the program

Fully implemented

Initiative year of inception

2021

Funding structure of administering organization

Privately funded for-profit

Geographic coverage

Global

Relative cost and level of effort required

Moderat

Transparency

All initiative requirements and methodologies are fully transparent and publicly available. All calculations, methodologies, and scoring criteria are clearly defined.

Oil and Gas Methane Partnership (OGMP 2.0)

Certification - LNG

Key takeaways

OGMP 2.0 is a comprehensive methane reporting framework for the oil and gas industry, requiring the implementation of measurement-based technologies both at the source-level and site-level. These measurements must be conducted using strict science-based measurement standards.

Participating companies commit to reporting their methane emissions from all operated and non-operated assets across the value chain each year.

OGMP 2.0 provides members a platform to credibly report on methane emissions performance, identify best mitigation options , and engage with and contribute to the leading process for methane management globally.

What’s new in 2023?

Company data were collected and analyzed in the second OGMP 2.0 annual report

Approval of additional OGMP 2.0 Technical Guidance Documents outlining source-specific quantification methodologies, including guidance on Uncertainty & Reconciliation

Revision of reporting templates and associated guidance

Trend of adoption

Quick Facts

Emission scopes coverage

Scope 1

Name of administering organization(s)

United Nations Environment Programme

Status of the program

Fully implemented

Initiative year of inception

November 2020

Funding structure of administering organization

Publicly funded non-profit

Geographic coverage

Global

Relative cost and level of effort required

Moderate

Transparency

All initiative requirements and methodologies are fully transparent and publicly available. All calculations, methodologies, and scoring criteria are clearly defined.

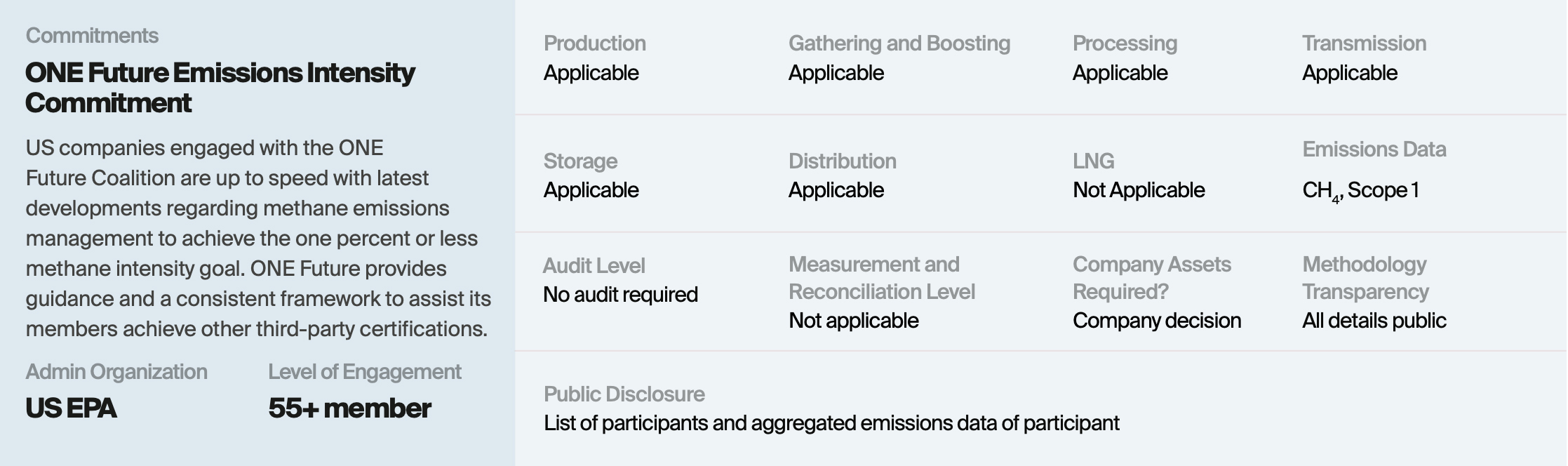

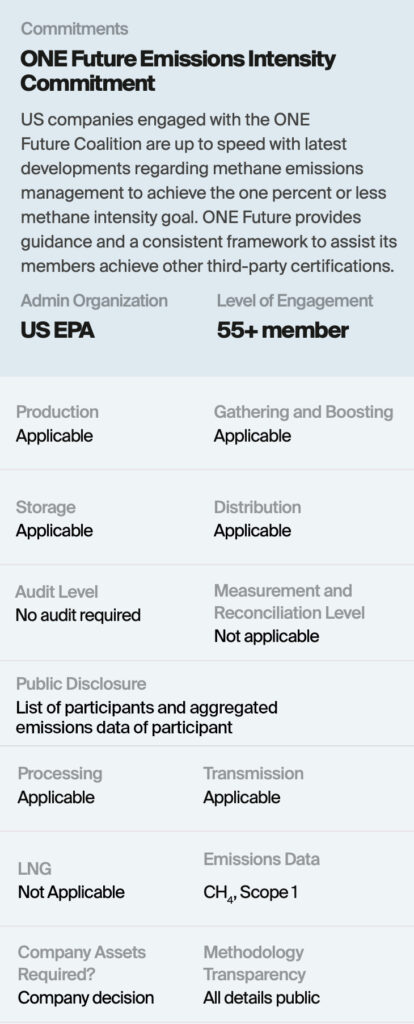

EPA Methane Challenge

Commitment

Key takeaways

The U.S. Environmental Protection Agency (EPA) Methane Challenge Program is a commitment-driven program that requires participants to transparently report actions towards methane emission reductions every year. Since 2016, the Methane Challenge Program has offered participants two distinct pathways toward emissions reduction, each with its benchmarks and reporting procedures.

The Best Management Practices (BMP) option in the Program is a pathway designed to create a near-term implementation of methane mitigation strategies across the entire oil and gas value chain. Companies will choose at least one emission source appropriate for their industry segment and commit to implementing the best management practice for that specific source across their operations. This commitment includes a five-year timeframe for company-wide implementation. The BMP option also mandates annual reporting procedures to be disclosed to the EPA regarding the rate of progress, key milestones, and context for implementation plans.

Additional commitment pathways:

Renewable Natural Gas

Equipment Leaks/ Fugitive Emissions Commitment Option for Compressor Isolation and Blowdown Valve Leakage

Participants who join the challenge have access to the benefits of peer networking, information sharing and technology transfer workshop opportunities, and public recognition highlighting individual company achievements.

Trend of adoption (cumulative)

Quick Facts

Emission scopes coverage

Scope 1

Name of administering organization(s)

US Environmental Protection Agency